- The wormhole shows promising results thanks to its high development activity.

- The price action chart revealed a short-term downtrend.

a Santiment A post on X (formerly Twitter) revealed that wormhole [W] It was higher Development activity Between Solana [SOL] Ecosystem projects last month.

It has comfortably outpaced the development activity of Solana and Jupiter [JUP].

Solana has had his share of pain in the past few days. The transaction failure rate reached 75% on April 6 and 7, bringing the network to its knees.

The increase in cross-chain traffic over the past month, partly fueled by demand for meme tokens, has also seen a decline in the number of daily active users.

The high development activity of the wormhole was an encouraging development. It also witnessed a rise in demand in the spot markets.

Compare the wormhole with Solana and Jupiter

source: Santiment on X

The 30-day wormhole development activity was 189. Meanwhile, Solana was at 108.2 and Jupiter was at 83.07.

In a post on Medium, Santiment explained why tracking events provides a better understanding of development activity than just what GitHub commits.

The term event includes the number of code pushes, pull request interactions, GitHub wiki edits, and more. The result is that greater activity generally equals greater belief in the ultimate success of the project.

It's a metric that goes a long way to reassure investors that the project will roll out more features and reduces the possibility of the project being a scam.

Technical analysis highlights two main levels, but there is a problem

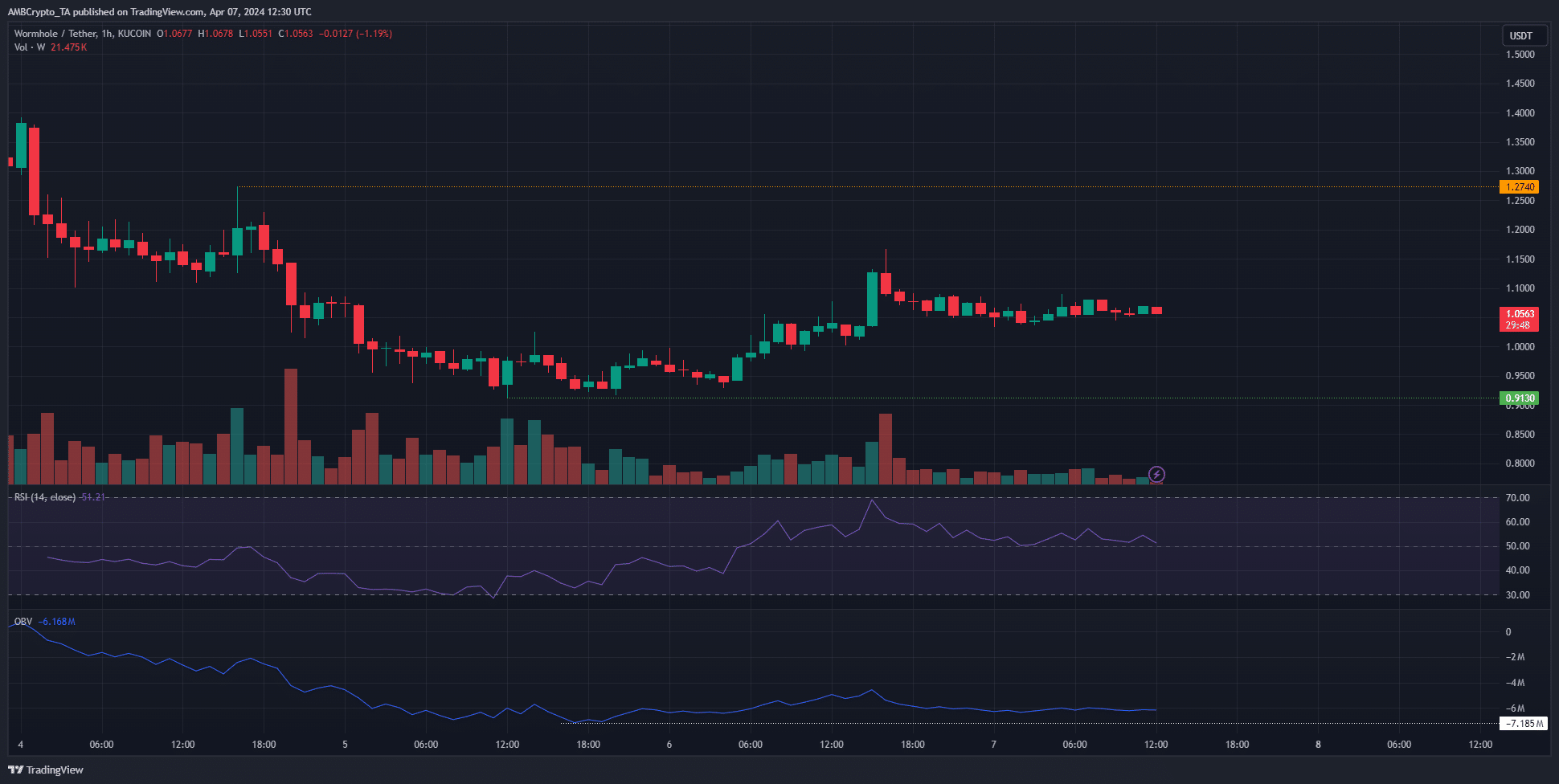

Source: W/USDT on TradingView

The 1-hour chart of W revealed a bearish market structure. If the swing low at $0.913 is broken, it will indicate bearish continuation and further losses for the token.

The price witnessed a bounce from $0.913 to $1.05 in the past two days. Besides, the OBV index also rose slightly. However, trading volume has trended downward since March 5th.

The Relative Strength Index on the H1 chart was at 51, indicating that neither bulls nor bears have the upper hand in the short term.

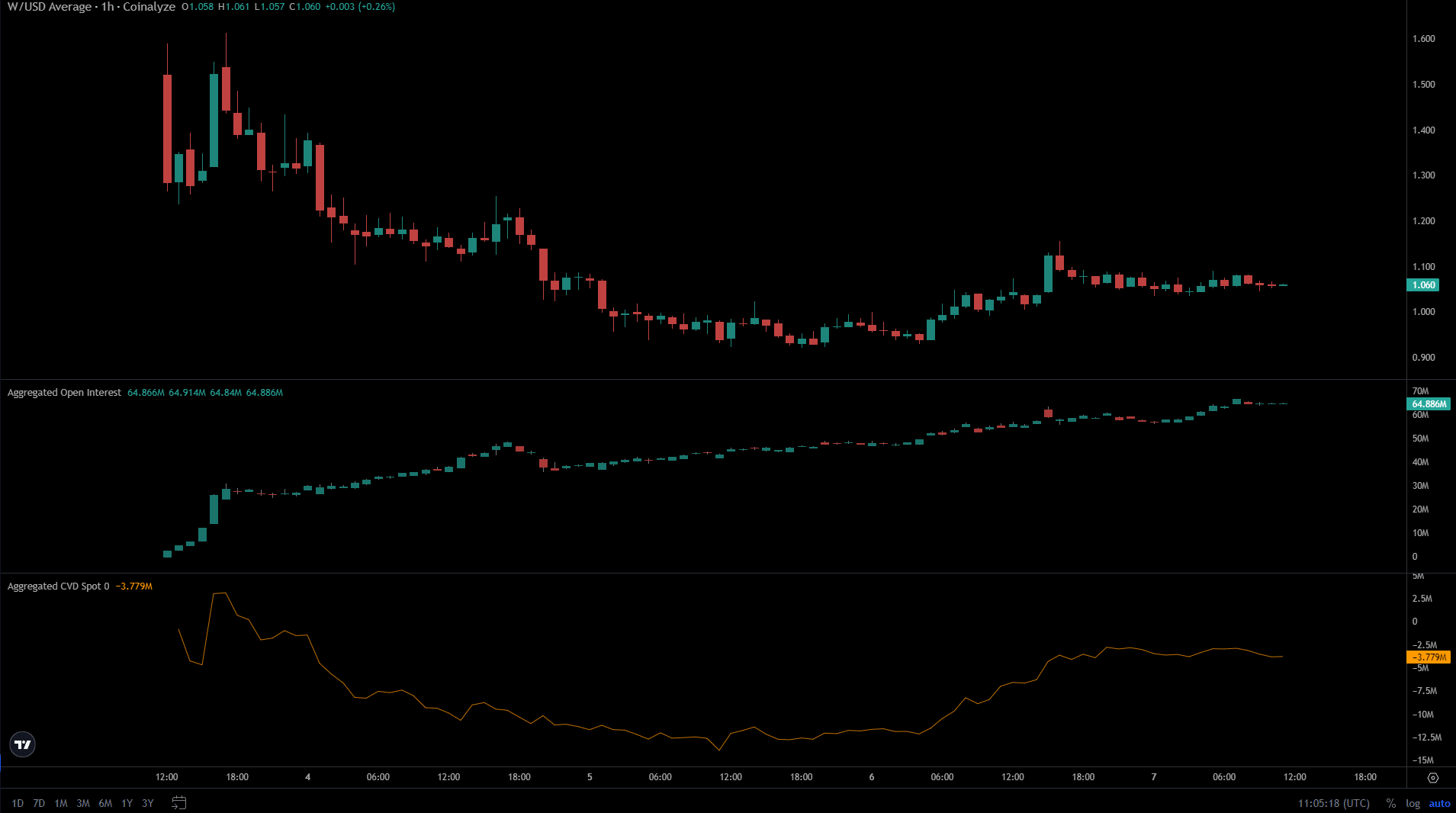

source: Currency analysis

Conversely, W's spot CVD has seen a significant rise over the past 24 hours. This indicates increasing demand in the spot markets.

Open interest was also trending higher, even as prices struggled to halt their decline.

Is your wallet green? Check out W Profit Calculator

What is important here is that the price movement is very small. With trading data only available for a few days, it is difficult to determine where W could move next.

As things stand, the $1.27 level, if broken, could see Wormhole rally.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”