The free money virus has turned investors’ brains to mush. But the recovery is starting, interest rates are recovering, the QT is here, and look what we’ve got.

by Wolf Richter for Wolf Street.

Let’s just browse some of the already exploding stocks that collapsed even more on Friday. There were quite a few of them, as is usually the case now during earnings season, but we’ll take a look at just a handful. They collapsed even as the markets rebounded that day. On Friday, the Nasdaq rose 1.3%, trimming its loss for the week to just 5.6%, from this type of week. But a whole bunch of things fell apart after the “earnings” were reported – I’m using that term loosely because they all reported huge losses as well as endless losses.

Carvanaan online used car retailer, is one of the oldest entries in my Pantheon exploding stocks. Thursday evening, I mentioned “earnings” – you know what I mean. Everything went wrong: the number of vehicles it sold to retail customers went down, revenue went down, cost of sales jumped, gross profit went down, selling and administrative expenses went up, interest expense more than tripled, and net losses exploded to $508 million.

Used car startups Carvana, Vroom and Shift “face an existential crisis,” I wrote in April 2022based on the changing dynamics of the used car market, the fading desire of investors to keep fueling the cash-burning machines, and motivated by the same used car startups that were never built to make money and never able to figure out how to make money, not even in the most car market. The hottest used ever in 2021.

They are designed to burn investor money. Investors no longer want to burn their money. And so that existential crisis is now.

Back when I issued the existential crisis warning in April 2022, Carvana [CVNA] It’s down 73% from its high to $100 a share. Since then, they have immersed themselves further in relentless brutality. On Friday, the price of Carvana was up 39% to $8.76, down 98% from its peak in August 2021, and down 41% from its IPO price in April 2017. Buy and keep people.

The chart displays the now classic pattern of how trillions of dollars from the Fed in quantitative easing and interest rate suppression – the era of free money began in 2009 – has mutated over the years into a virus that has turned investors’ brains into mush, and after their brains were affected they turned to mush, inflated investors’ brains to mush. Asset prices are at ridiculous levels.

But the recovery from the free money virus has begun. Interest rates are back to kind of normal, Qt is working now, and look what we got. Almost all charts for separate stocks look the same (data via YCharts):

In a market where investors’ brains are working properly, Carvana’s inability to make money selling used cars should have wiped out stocks in the small-cap world years ago.

Armies of fallen knife hunters who thought they could make money after stocks plunged 73% in April 2022 have cut their beloved fingers off another 91%. Stocks have collapsed so far that you can barely see 38% slump on Friday, that slight drop at the end of the crash.

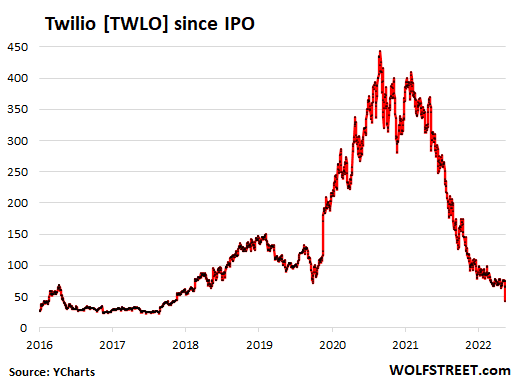

Twilio [TWLO], a cloud communications platform, reported “earnings” on Friday morning. Part of the problem was that revenue grew 32% to $983 million, while net losses rose 115% to $482 million. The company also issued disappointing revenue guidance.

How can a company that has been publicly traded for seven years, has been around for 14 years, and has had $3.5 billion in revenue over the past 12 months, generate $482 million in losses for $983 million in revenue? This was a rhetorical question.

Each year, the company incurs bigger and bigger net losses, reaching nearly $1 billion in 2021, and heading toward more than $1 billion this year, following the Silicon Valley virus-free financial model: the more they sell, the more they sell. they lose.

People who run businesses in this way have no idea what it’s like to run a profitable business. It’s not on their horizon, and it wasn’t on their investors’ horizon. But it started.

Shares collapsed 34.6% on Friday, down 91% from their infamous February 2021 highs, when those things started to fade. Now note the classic exploding stocks Bubble and collapse pattern. It’s just a simple fact: Free money turns investors’ minds to mush (data via YCharts).

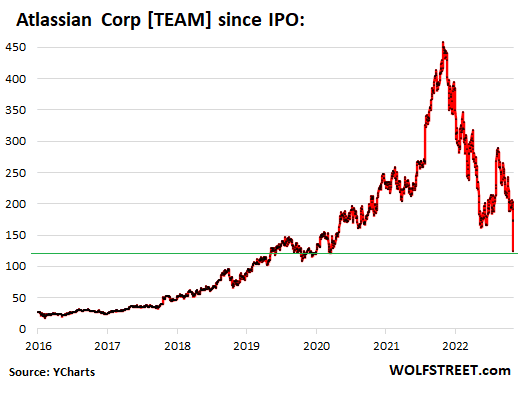

Atlassian Corp. [TEAM], a collaboration and productivity software company in Australia that is traded on NASDAQ, is another one of the shiny free money examples that has never figured out how to make money, never tried it, and even loses huge amounts of money after a year. – The year: In the past four years alone, it has lost a combined $2.3 billion, even as its revenue has gone up.

In other words, it only buys its own revenue. And for a while, that was all that mattered to investors whose brains had been turned to mush by the free money virus.

But when the company announced earnings on Friday, it spoke of feeling the impact of the global economy — a slowdown in hiring for its existing customers slowing demand for collaboration software — and said the rate at which users of the free versions are converting to paid ones. The versions were cooling. She said it would slow future headcount growth, and made a disappointing forecast.

Shares are up 29% Friday to $124.01 and are down 74% from their manic peak in October of last year. This chart looks very close to the Carvana chart that appeared in April when it dropped to $100. Each implosion had a different start date, and each dive brought out buyers who then sliced off their fingers, and it will happen again because there are still buyers dunking there with some fingers left on their hands that they want sliced off. Off (data via YCharts):

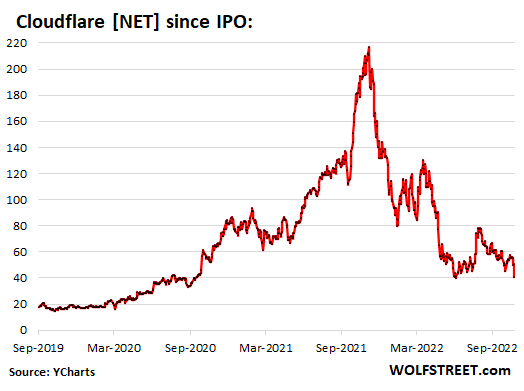

Cloud Flare, a cybersecurity company, reported earnings late Thursday — yes, another big loss. While revenue jumped 47%, operating loss jumped 73%. The more they sell, the more they lose—following the Silicon Valley growth model during the free money virus era. Steering was light, too.

But the free money virus is fading, brains are recovering from it, and on Friday its shares rose 18.4%, to $41.09, down 81% from their peak in November last year.

Stock is about eight months behind the first batch of champs in my Pantheon of exploding stocks that started not sticking in February 2021 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a glass of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”