- SOL stock is down more than 20% in the past seven days.

- Some technical metrics and indicators have turned bullish on SOL.

Solana [SOL] It was one of the hardest-hit altcoins during the market crash, as the value of the token dropped by double digits.

However, things could get worse for Solana, as its price has fallen below a crucial support level.

Solana drowns

according to CoinMarketCapSolana stock has fallen more than 20% in the past seven days. In the past 24 hours alone, the value of the token has fallen by more than 6%.

At the time of writing, SOL is trading at $142.9 with a market capitalization of over $63 billion.

In an additional bit of bad news, while the price of the token fell, its trading volume rose by more than 70%, legitimizing the downtrend.

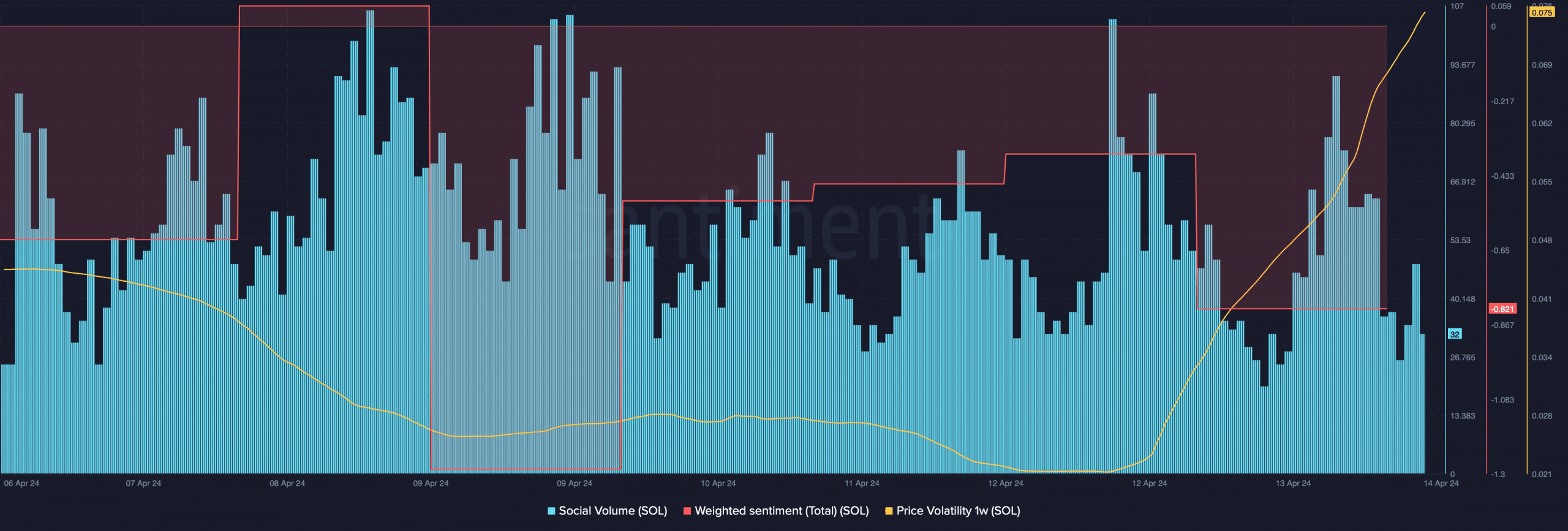

AMBCrypto analysis of Santiment data revealed higher SOL price volatility for the first week. Bearish sentiment around the token also remained dominant, which was evident from the drop in weighted sentiment.

However, SOL's social volume has remained high, reflecting its popularity in the cryptocurrency space.

Source: Santiment

However, Solana's concerns are not over yet, as the value of the token fell below the critical support zone.

Crypto Tony, a popular cryptocurrency analyst, recently published an article tweet Noting that SOL price was testing its support near $150.99. Unfortunately, at the time of writing, the price of the token has dropped.

This indicates that Solana investors may see a further decline in the price of the token in the coming days.

Solana support levels

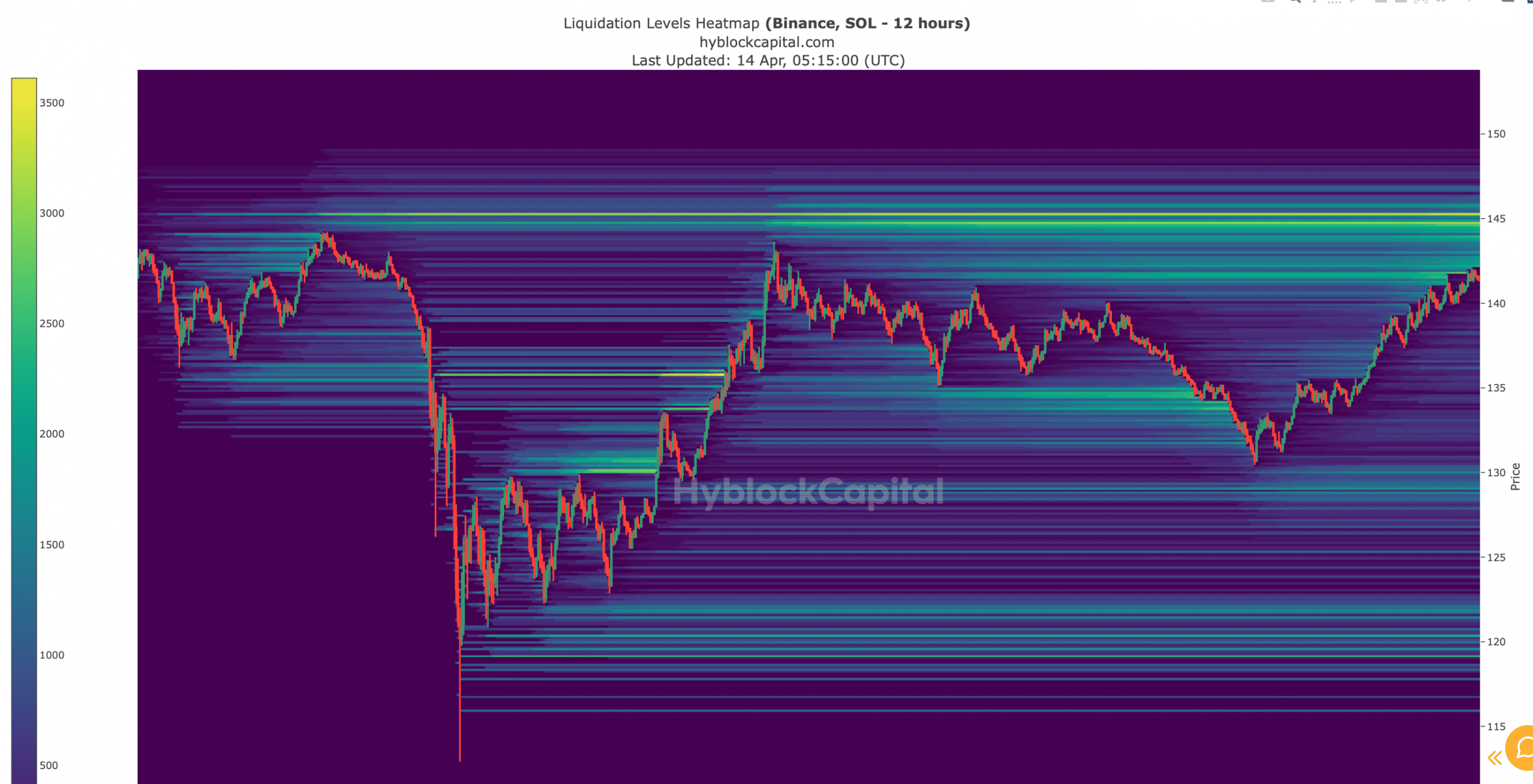

AMBCrypto then examined Hyblock Capital data to find the next potential support levels for SOL. According to our analysis, SOL liquidation will increase sharply near $130, which could act as support.

If the token fails to test this, its price could fall further to $120 before gaining upward momentum.

Source: HiplockFC Capital

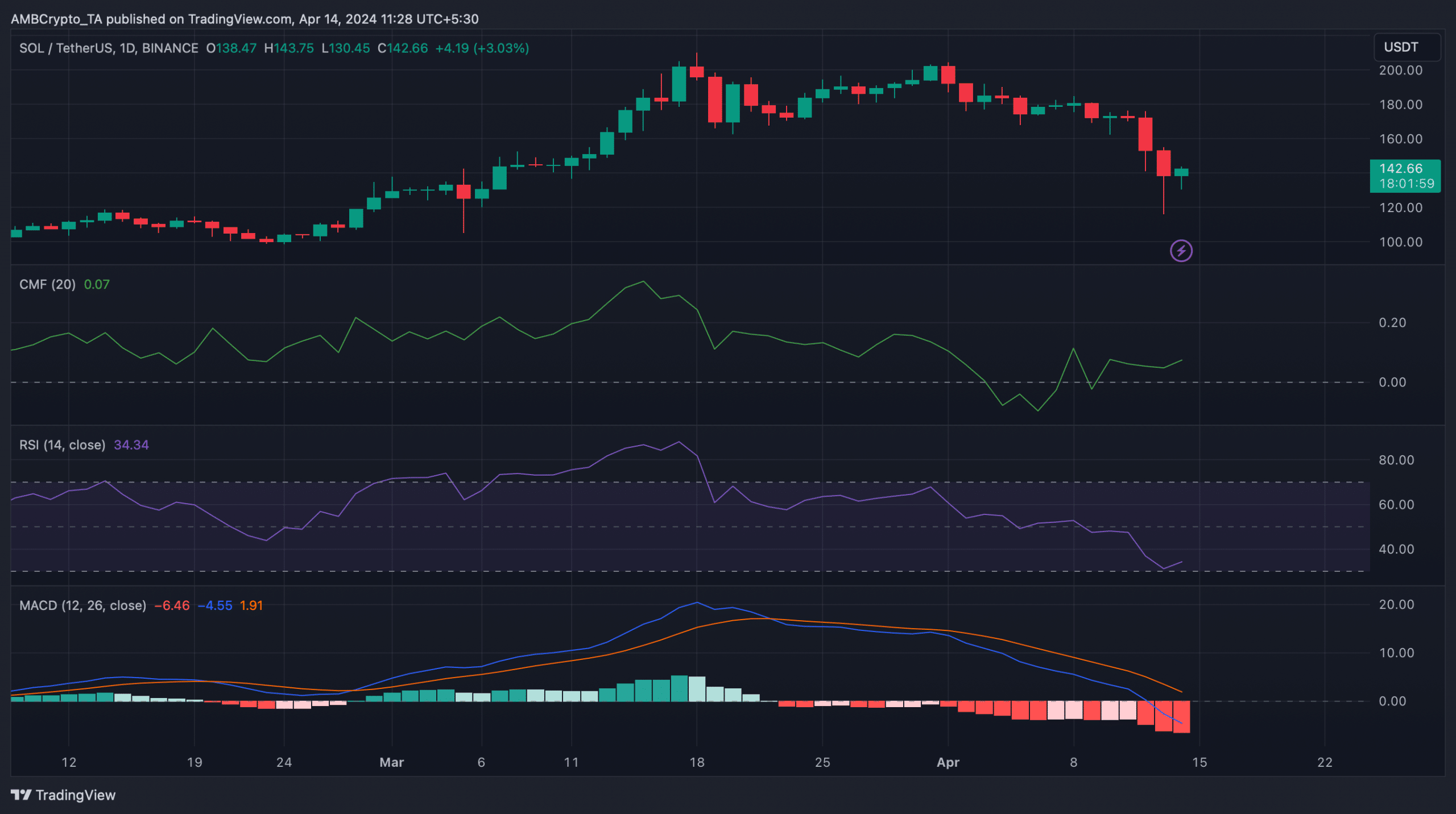

The technical indicator MACD also showed an upper downtrend in the market, indicating further decline in prices. However, the rest of the indicators turned bullish and hinted at a possible trend reversal.

For example, the Relative Strength Index (RSI) rose after touching the oversold zone. In addition, the Chaikin Money Flow (CMF) indicator also rose from the neutral mark of 0.

Source: Trading View

is reading Solana [SOL] Price prediction 2024-25

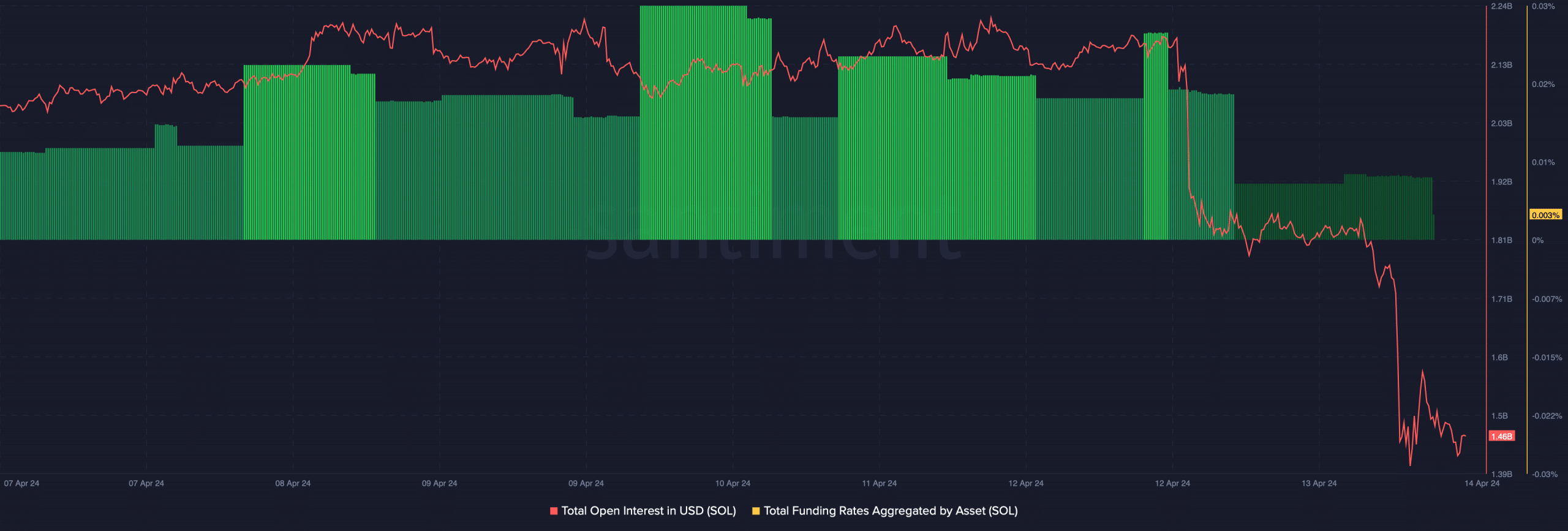

Apart from this, things in the derivatives market have turned to the upside. The token's open interest declined sharply along with its price.

A decline in the metric usually indicates that current market trends may change. Solana's funding price also fell, meaning derivatives investors were not buying SOL at its low price at press time.

Source: Santiment

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”