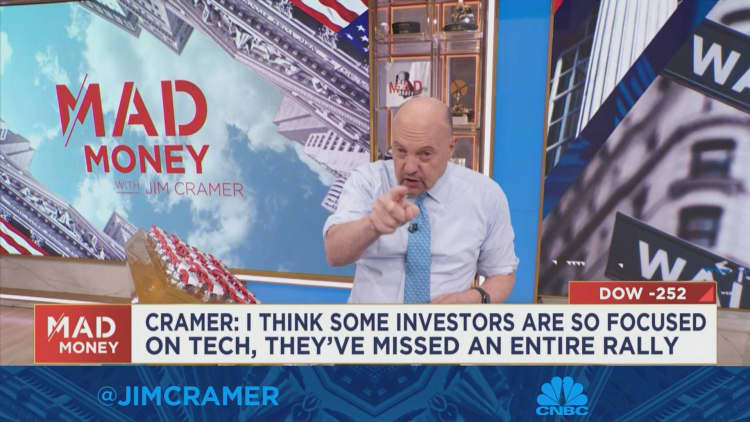

The carnage in tech stocks hides a bull market with other names, CNBC’s Jim Cramer said Thursday.

“We’ve had a very traditional bull market based on the dollar and interest rates peaking, both of which tend to be great for equities for a whole host of reasons,” he said, adding that “the continued rout of Teslas and Salesforces and Amazons” overshadows it.

Stocks fell on Thursday after the Labor Department reported that initial filings for unemployment insurance fell to their lowest level since September, suggesting the job market remains hot despite the Fed. raise interest rates.

Related investment news

He said that while stocks have taken a hit in recent days, many are still up overall. Corporate shares incl visaAnd Master Card Credit CardAnd c. B. Morgan Chase And Boeing It bottomed out late last year, according to Kramer.

“These huge stocks have seen huge, brutal moves in the last few months – what we’ve seen this week is Just an orderly descent To burn out a massive overbought condition.”

Kramer, who remained adamant that investors are staying away from the big-cap technology name, and asked investors not to make the same mistake Wall Street made by falling for technology stock dips.

“Let’s remember, there are two paths out there. The technological one, which can’t seem to find its footing, is rooted in about 30% of the market, and the other path, which has been finding its footing for months and months and months,” he said.

Disclaimer: The Cramer’s Charitable Trust owns stakes in Salesforce and Amazon.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”