- Long-term Ethereum backlog addresses now hold more than 19 million ETH, nearly doubling since January 2024.

- With approximately 29% of the total supply of ETH, lower market liquidity could support price stability in the future.

Ethereum [ETH] It has been seeing a surge in long-term accumulation, with over 19 million ETH in addresses as of October 18.

This represents a significant rise from 11.5 million ETH at the beginning of the year, reflecting growing confidence among investors about Ethereum’s long-term prospects.

Ethereum accumulation rises

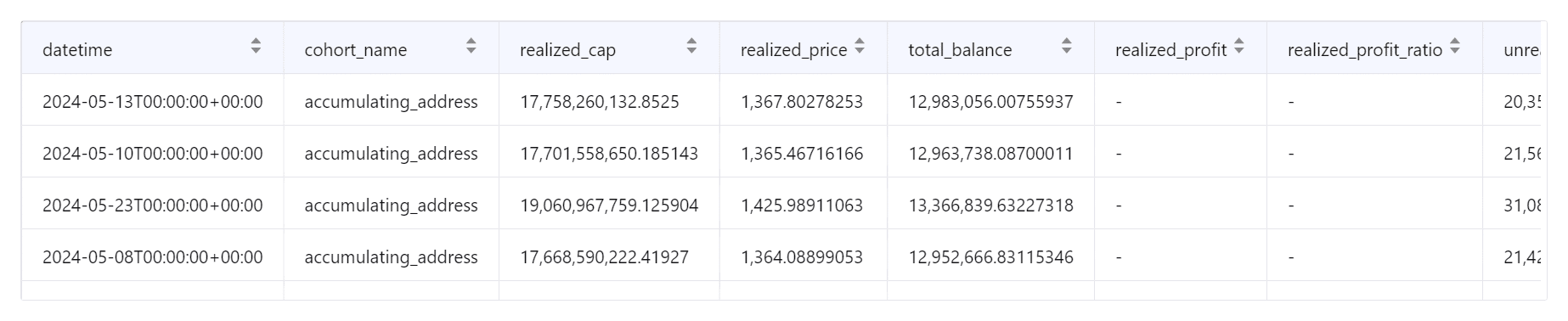

Data from Cryptoquant It revealed a significant increase in Ethereum held in accumulator addresses. In January 2024, these addresses held 11.5 million ETH, and by October, that number had nearly doubled.

Experts suggest that by the end of the year, the amount held in these addresses may exceed 20 million Ethereum, continuing this upward trend.

Source: Cryptoquant

This increase in long-term holdings indicates that large investors and backers of ETH are building their positions with the expectation of future growth.

The approval of spot ETFs in early 2024 has also contributed to this buildup by drawing more mainstream attention to ETH. The rise in ETH stakes is another driving force behind the growing accumulation.

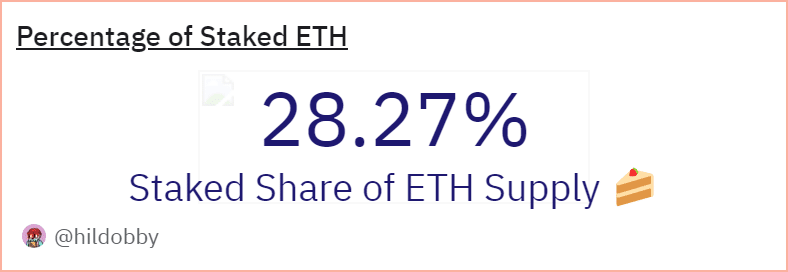

Ethereum has swept 30% of the supply

As staking grows, staking has also become a key factor in the Ethereum market dynamics. Data from Dune analyses It shows that 34,600,896 Ethereum were stored at the time of publication, representing approximately 29% of the total Ethereum supply.

Source: Dion Analytics

With a significant portion of ETH now locked into mortgage contracts, the overall market may experience a reduction in selling pressure.

This could provide support for the price of Ethereum in the near future, as less ETH is available for trading, which could contribute to price stability or even further price appreciation.

Ethereum maintains a positive trend

At the time of writing, Ethereum was trading at $2,649, slightly above key support levels.

The 50-day moving average at $2,476 provided strong support, while the 200-day moving average at $3,022 served as a critical resistance point.

A break above this resistance level will be necessary for ETH to sustain the rally in the long term.

Source: Trading View

The Relative Strength Index (RSI) is at 61.61, indicating moderate upward momentum without entering the overbought zone.

Read about Ethereum [ETH] Price forecasts 2024-25

Meanwhile, Chaikin Cash Flow (CMF) was slightly negative at -0.07, reflecting limited buying pressure but not enough to indicate a downtrend reversal.

Although Ethereum maintains a positive outlook, clearing the $3,022 resistance level is key to a stronger upward trajectory. If market volatility emerges, the 50-day moving average at $2,476 could serve as crucial support.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”