Since the start of the COVID-19 pandemic two years ago, a new crowd of retail investors has emerged, pouring extra money into stock markets and taking Wall Street to places they never dreamed of, like Mimi’s stock.

for us Today’s callfrom the founder and CEO of Zingeroo Competitive Stock Trading AppInstitutional traders say they would be wise to continue to pay attention to an increasingly sophisticated retail investor.

Prepandemic, Zoë Barry, president of Zingeroo, notes that the retail crowd represents 10% of the volume that has been traded and hasn’t been involved in trading ideas – often seen in Gen. X and the older crowd. Then that number reached 25%, and with it came a lot of the most talkative investors.

“[Wall Street] Barry completely underestimated what it would be like if 25% of volume shifted in a certain direction and shifted away from institutions,” Barry told MarketWatch in a recent interview.

“ “… Gen. Z has really started sharpening their pencils and doing research on what to do in a bear market.” “

“And now Wall Street is full of sentiment data and they are looking at what people are seeing, but they also want the underlying trading numbers because there is a gap between what people are talking about and saying online, versus what they are actually trading,” he said.

As a former analyst at Dawson Capital, Barry said she wanted to know what traders were saying versus what they were trading, and why there are flows into some stocks. “If I were an institution, I would be very wary of shorting stocks that would potentially be the heart of retail investors,” she said.

The Barry app, launched last fall, is a competitor to Robinhood HOOD,

But it features ‘bulppens’ – chat groups for discussing investment topics – and ‘zones’, where performance can be measured against others, while trades can be verified via ‘trading cards’.

The Initiative 80% of Zingeroo users said they are Millennials and Generation Z, and the rest are Gen. X plus. The younger crowd, she said, views the business as a so-called “Master of Business Administration” – investing in themselves and their financial diversity.

“I think young retail investors are starting to get a long-term outlook from what you only know, what is happening this week in the markets. I think that is generally positive for them,” she said. They have financial literacy and that’s a positive thing.”

And in the early part of the quarter, there was a lot of talk about young investors getting lost in the wilds of a bear market. “And what we’ve seen is that Gen Z has really started sharpening his pencils and doing research on what to do in a bear market,” Barry said.

As for the differences between generations, she said the Gen. X plus will auto-liquidate with stop losses, Millennials tend to buy the dip, while Gen. Z is more advanced. For example, I noticed the last action on SQQQ SQQQ,

A triple inverse trading fund that tracks the NASDAQ 100 index, called this “definitely unusual behavior for a retail investor.”

“They basically said we’re not sure which growing stocks will be affected the most, so I’m not smart enough as a retail investor to pick exactly which stocks are going to pull out,” Barry said. Nor are they concerned about exactly bottoming out the market, but instead look at stocks that they think will stand a higher chance of fundamental success going forward.”

This crowd, Barry said, “understands the future tools that are happening now,” and they are generally more optimistic about themselves, their future potential and the economy in general, despite the geopolitical meltdown and rising inflation.

commotion

Twitter TWTR,

Shares are up 25%, on the back of news Tesla CEO Elon Musk He owns 9.2% of the shares. Tesla TSLA,

delivery, meanwhile, rose in the first quarterbut he missed Wall Street expectations, despite JP Morgan raised its target price.

Starbucks SBUX,

announce Cessation of share buybackscoinciding with the return of Howard Schultz as CEO.

The United States and Europe are ready More sanctions against Russiamiddle Terrifying photos and reports Of the unarmed Ukrainians executed in Bucha, Kiev and elsewhere.

Read: Russia’s war could escalate car prices and shortages

Ukrainian President Volodymyr Zelensky Emotional Grammy lookfor his country. John Baptiste was honored at the controversy-free Awards for Album of the Year, among other things.

Jamie Dimon, CEO of JPMorgan, said the ongoing war Bad News for the global economy.

Amid the lockdowns in China, authorities have reported a New subtype of omicron.

Factory orders advance in a thin data week that will include minutes from the Federal Reserve. San Francisco Fed President Mary Daley said the case for a half-point interest rate increase in May has risen.

markets

DJIA stock,

SPX,

COMP,

be mixedCL00 oil prices,

BRN00,

climbing While investors are considering the possibility of increasing sanctions against Russia. The inversion of the curve remains, with the yield on the two-year note TMUBMUSD02Y,

Above TMUBMUSD10Y for 10 years,

Bitcoin BTCUSD,

Lightens the last run.

graph

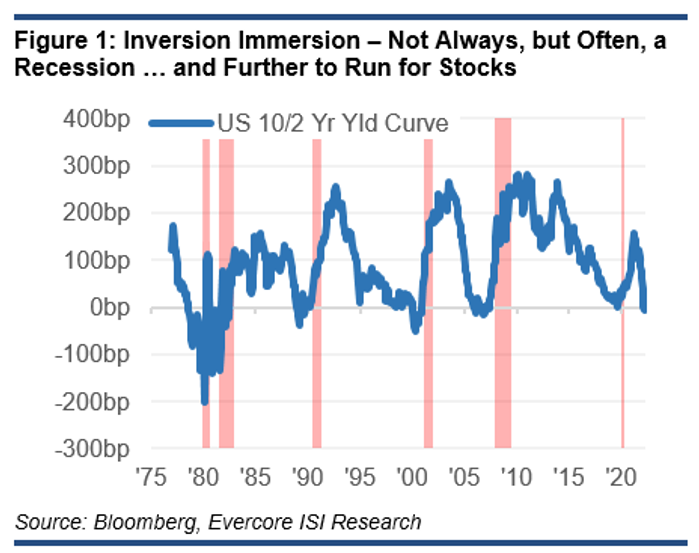

One consistent theme is strong returns from the point of a yield curve inversion to the eventual top of the stock market. It is also worth noting that if the rise of 1/4/22 S&P 500 marks the first peak in the stock market before “A reversal in 40 years,” a team of strategists at Evercore said in a note. This is the graph:

Note that Goldman Sachs also focused on this topic in a recent research report, noting that S&P 500 returns were typically positive in the two years following the yield curve inversion, with the exception of the 1973 high-inflation period, when it eventually entered a bear market.

Indications

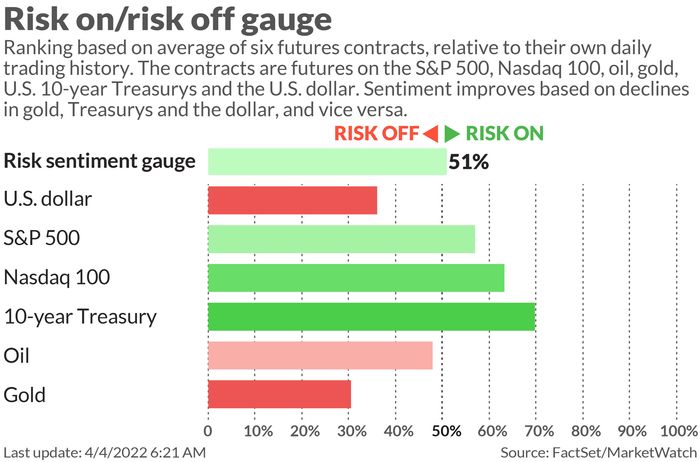

These were the most searched indicators on MarketWatch as of 6AM ET:

random readings

German man accused Get 90 vaccines for COVID-19To sell his cards to anyone who wanted to avoid punches.

Need to Know starts early and is updated until the opening bell, but Register here To be delivered once to your email inbox. The emailed copy will be sent out at approximately 7:30 AM ET.

Want more for the next day? sign for Baron Dailya morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”