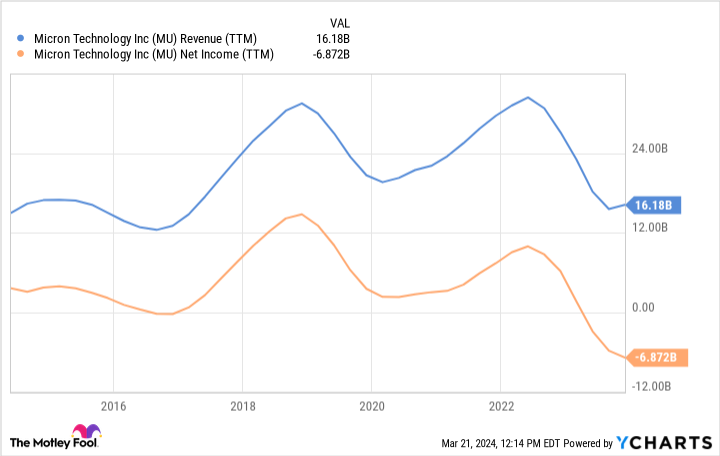

The recent downturn in the semiconductor industry, led by a sharp decline in spending on consumer electronics (computers and smartphones) after the pandemic, has been particularly tough on the US memory chip maker. Micron technology (NASDAQ: MU). However, Micron is back in inclusive growth mode, and has just transitioned into inclusive growth mode Generally accepted accounting principles Profit again in the last reported quarter (2QFY2024, three months ending February 2024). This is thanks to the return of regular purchases of computers and smartphones, but there is another major factor Nvidia's (Nasdaq: NVDA) The generative artificial intelligence (AI) revolution.

Micron's return to profitability has major implications for its stock (as well as for memory chip manufacturing equipment and service providers such as… L Research (NASDAQ: LRCX)). But it also has huge potential implications for Nvidia and the AI infrastructure boom it's already generating. Here's what investors need to know.

Micron is fully reserved and fresh from the leading memory

As for the high-end stuff, Micron posted a 58% year-over-year increase in sales last quarter to $5.82 billion. Its rapid return to the last peak sales cycle, which occurred in 2022 at the end of the pandemic-induced chip shortage, will continue in the third quarter of fiscal 2024 (which ends in May). Management expects revenue of $6.6 billion at the midpoint of guidance, which equates to a 76% jump year over year.

This growth is impressive, but note that Micron is still reaping its horribly low financial results from the depths of the bear market a year ago.

This is still great news for Micron, which finally reported again net GAAP earnings of $793 million (or $476 million on an adjusted basis). The company has a lot to gain as it continues to ramp up manufacturing of HBM3e, the latest version of its third-generation high-bandwidth memory. HBM3e is used in accelerated computing and artificial intelligence — like the new Nvidia systems that were just announced at the annual GTC event last week.

The market has been volatile on a business that until just this quarter was running deep in the red. But investors were vindicated by this quote from Micron CEO Sanjay Mehrotra: “We are on track to generate several hundred million dollars in revenue from HBM in fiscal 2024 and expect HBM revenue to be accretive to our DRAM and overall gross margins starting at one-third Financial. “Our HBM inventory has been sold for calendar 2024, and the vast majority of our supply has already been allocated for 2025.”

In other words, it looks like the good times will continue for at least another year, if not longer.

Does Nvidia's stock run have legs?

All eyes have been on Nvidia's historic run, with its shares up more than 500% since the start of 2023. Even after that collapse, the stock is trading at 37 times Wall Street analysts' current-year EPS forecasts. .

This supports the expectation that Nvidia's profits will double compared to last year. Just as Micron expects AI computing growth to continue almost unabated through 2025, so do Nvidia investors. The fact that Micron's HBM manufacturing capacity is almost fully booked through 2025 is a strong indicator of Nvidia's demand for more high-end memory chips.

However, and this is the $2.3 trillion question (actually, that's Nvidia's approximate market cap as of this writing), Nvidia's demand for these HBM chips will depend on that it Customers continue to gobble up many of the accelerated computing systems they can run with partners like Micron.

But the field of semiconductor manufacturing is highly collaborative. It costs a lot of money to design, build, and sell these systems. Nvidia is unlikely to book large orders from Micron if it does not obtain advance orders from its large technology data center customers.

Surely this party will end one day. But so far, it looks like Nvidia has a lot of runway ahead of it. Micron also said so in its latest earnings update.

Should you invest $1,000 in Micron Technology now?

Before you buy shares in Micron Technology, consider the following:

the Motley Fool stock advisor The analyst team has just defined what they think it is Top 10 stocks Investors are buying it now… and Micron Technology wasn't one of them. The 10 stocks that were discounted could deliver huge returns in the coming years.

Stock advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. the Stock advisor The service has more than tripled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Nicholas Rossolillo His clients hold positions at Lam Research, Micron Technology, and Nvidia. The Motley Fool has positions in and recommends Lam Research and Nvidia. The Motley Fool has Disclosure policy.

Micron's high-bandwidth memory chips sold out – what does it mean for Nvidia's AI dominance? Originally published by The Motley Fool

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”