- The price of TVL is up almost 20% in just the last 30 days

- While the price of LDO has risen, so has online engagement with the project

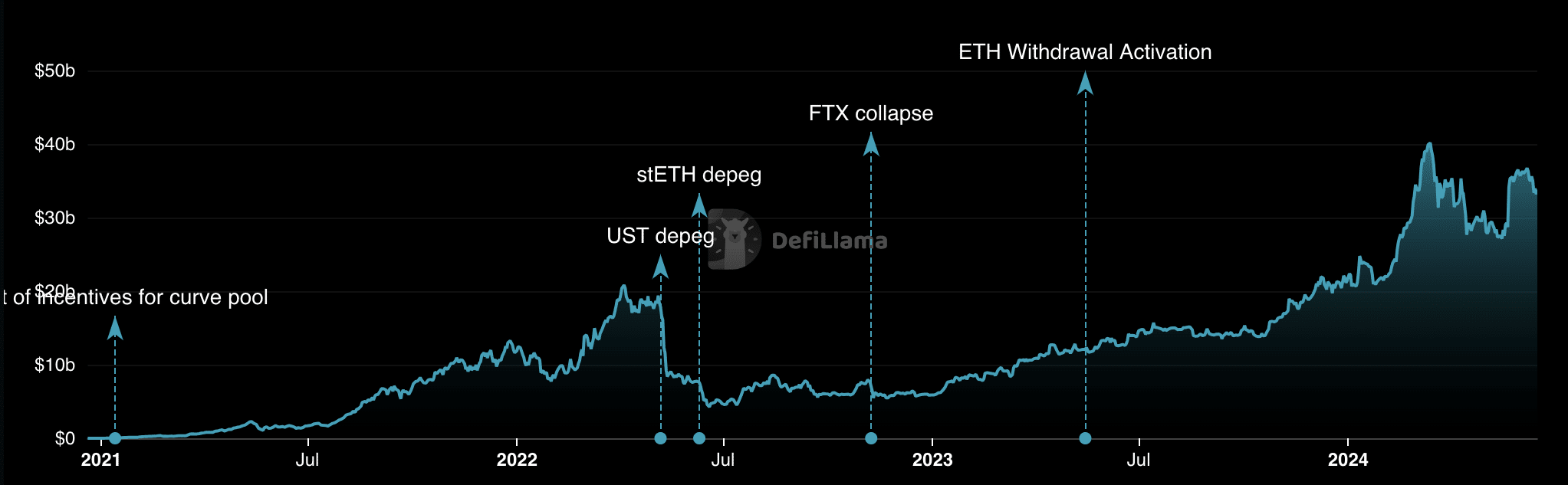

Lido Finance [LDO]A liquid staking platform built on Ethereum [ETH] The blockchain has regained the top spot in total value locked (TVL).

At press time, Lido’s TVL was $33.77 billion. This is after a 19.51% rise over the past 30 days. Here, TVL measures the total value of assets locked in the protocol. An increase in this metric indicates that users trust the protocol to provide a good return.

Lido takes the baton from EigenLayer

On the other hand, a decline indicates doubts about the potential returns that the project may offer. So, Recent rise It implies that market participants are now back to trusting Lido on this front again.

Source: Devilama

A few weeks ago, EigenLayer took over the leaderboard. This is after the project’s early users expected rewards for their participation. In May, EigenLayer launched the non-transferable EIGEN token, which led to increased withdrawals from the protocol.

This decline, which brought Eigen’s TVL to US$18.81 billion, gave Lido Finance the opportunity to top the list again. However, apart from Lido’s TVL, the project’s native token, LDO, also recorded an increase in the charts.

According to CoinMarketCap, LDO is valued at $2.05 at press time, representing a 5.12% rise over the past 24 hours. The price surge made the token one of the best performing coins on the market at a time when the rest of the market bled.

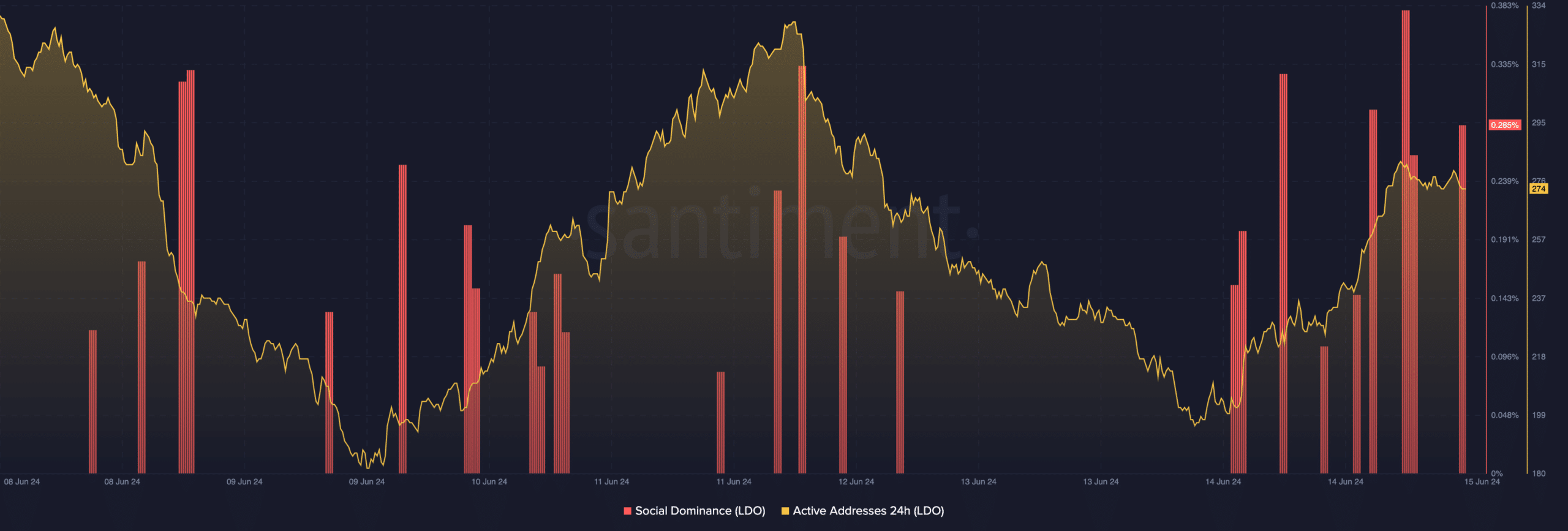

From a series perspective, there seems to be a good level of activity going on behind the scenes with Lido as well.

Attention turns, but will LDO keep $2?

At the time of writing, social dominance has risen to 0.285%. This metric measures community engagement with the project online. Therefore, higher social dominance means higher interest in LDO.

As such, it is not surprising that High interest led to demand. However, if the discussion around LDO becomes heated, it could trigger a pullback in the token’s price.

If so, the value of the original Lido token could fall below $2. So, it is worth noting the fact that 24-hour active addresses on the Lido network have been increasing since June 14.

Source: Santiment

Active addresses refer to the number of unique addresses involved in transferring cryptocurrency. When the metric goes down, it means a decrease in interaction with the network.

However, the rise indicates that more users are visiting the blockchain. This was the last case for Lido at the time of writing, reinforcing the idea of greater interest in the project and the token as well.

While the price of LDO may later fall below $2, its medium-term potential may lie in ETH. Historically, LDO has shown a strong relationship with ETH.

Realistic or not, here is LDO’s market cap in terms of ETH

As speculation spreads that Ethereum ETFs will begin trading in July, Ethereum may rise. If so, the LDO may join as well.

Therefore, a potential rally above $3 may be possible by then.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”