- The metrics on the chain showed that bulls were keen to buy.

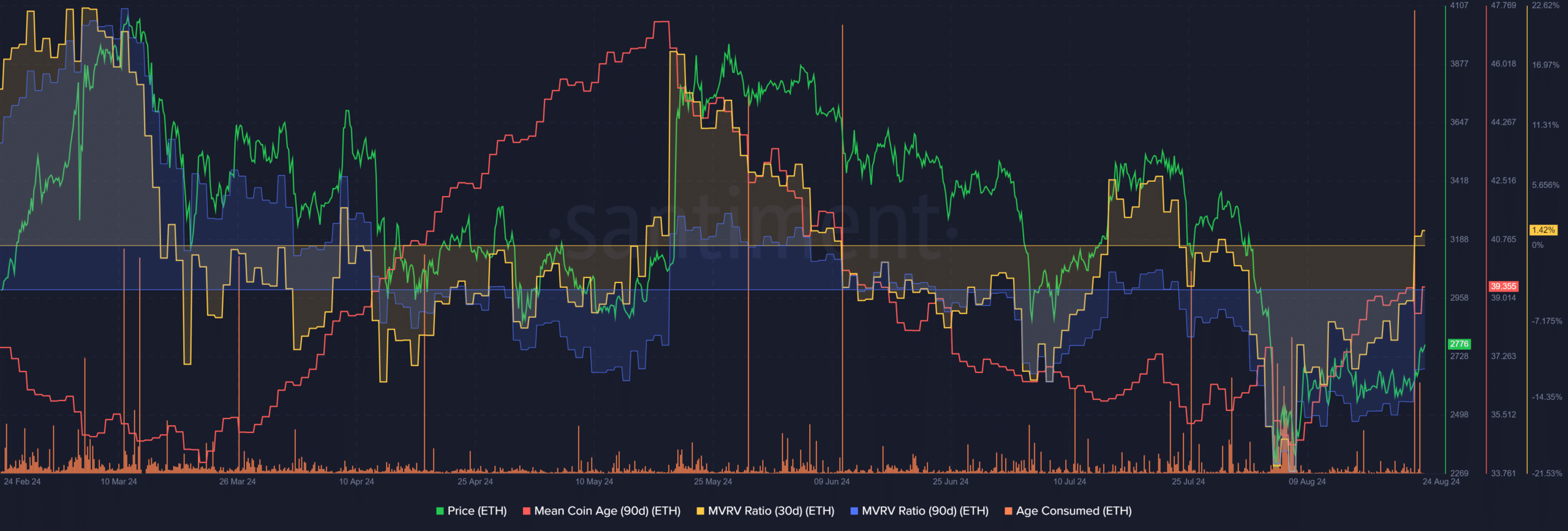

- The consumer age scale indicated caution while other scales showed caution.

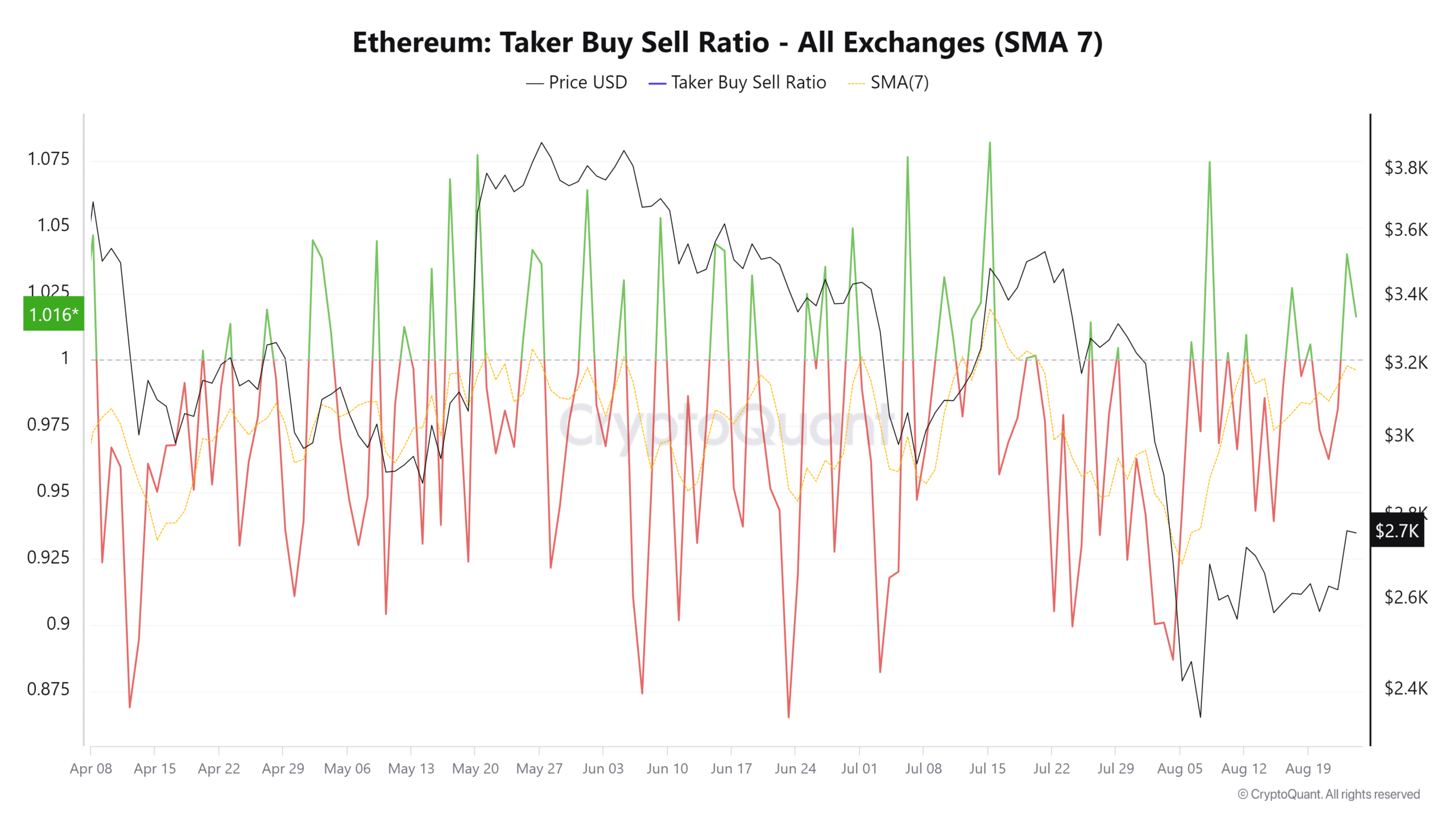

The buy/sell ratio has skyrocketed for Ethereum. [ETH] Over the past two days. This metric tracks the ratio of buying volume to selling volume. Values below 1 indicate bearish sentiment.

source: Crypto Quant

The term “taker” refers to the nature of the order placed, being a market order rather than a limit order. This means that these traders are willing to pay a slight premium to execute the trade at market prices. Therefore, this ratio helps measure sentiment.

Ethereum is on the road to recovery

On July 31, Ethereum was trading at $3.2K. Since July 20, the buy/sell ratio has been negative, indicating that bearish sentiment has been dominant. After the August 5 drop, the market rebound has encouraged long-term long positions.

The August 8 and August 23 readings, while bullish, may not be indicative of a sustained recovery.

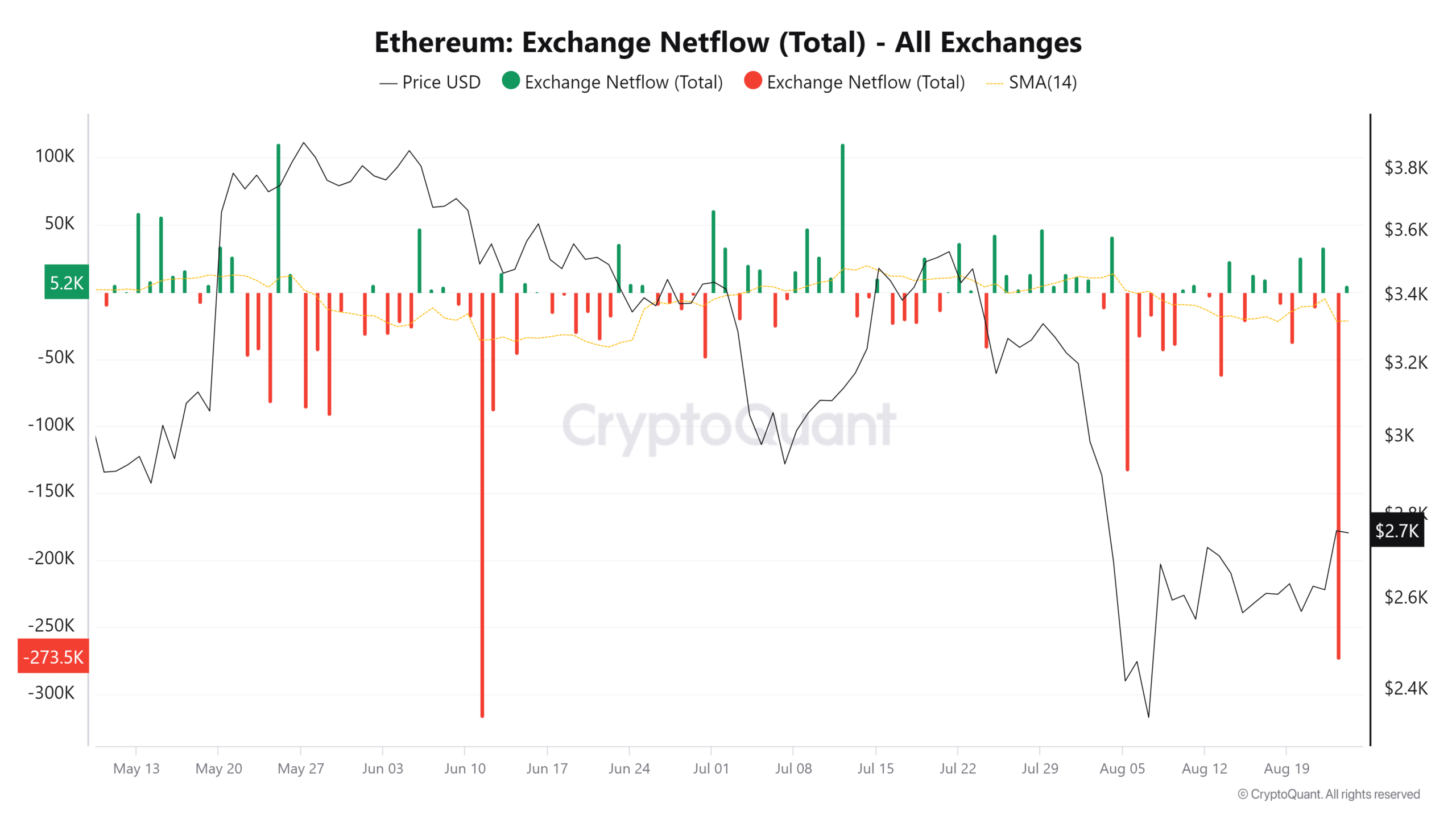

The influx of Ethereum from exchanges may shed more light on this. On the 23rd, there was a massive inflow of Ethereum, indicating accumulation. The 14-day simple moving average resumed the downtrend it had been in since the price drop in early August.

This was an encouraging sign and could push prices towards the $3K resistance area.

Should traders expect a break of $3k?

The 30-day average short-term interest rate has entered positive territory, indicating that short-term holders are making a marginal profit. The 90-day average short-term interest rate remains deeply negative. Meanwhile, the average life of the coin has been trending upward over the past three weeks.

This indicated a network-wide accumulation, which reinforced the bullish notion from the net flows metric. However, the lifetime consumption metric saw a massive spike to show increased token movement.

Is Your Wallet Green? Check Out Our Ethereum Earnings Calculator

Lower gas network fees mean that ETH supply could become inflationary over time, and could negatively impact ETH in the long run.

Such moves generally indicate a selling wave. Traders should be wary of selling pressure over the weekend and exercise caution during the Monday trading session.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”