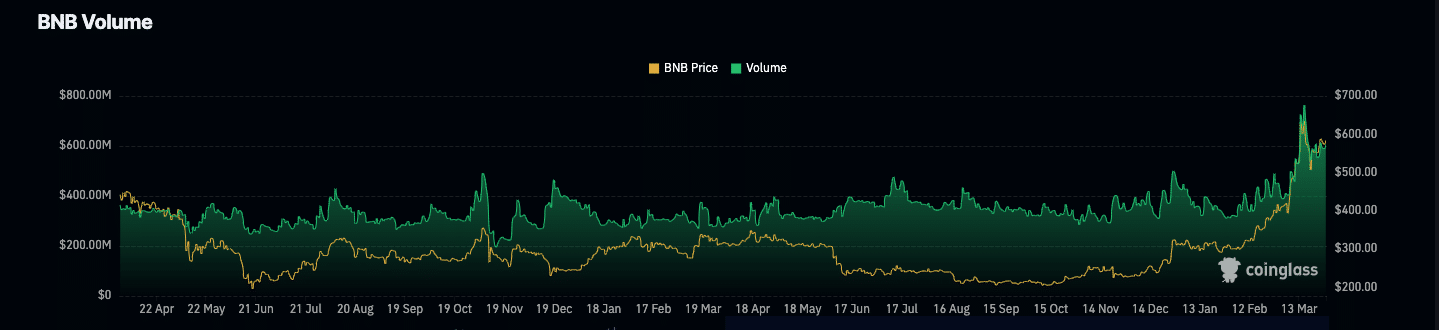

- Trading volume in the derivatives market has increased, indicating a significant upside.

- A comprehensive price analysis indicated that BNB could reach $694.

After AMBCrypto published predictions explaining how Binance Coin will work [BNB] It may exceed $600, and the coin now appears to be targeting another level.

At the time of writing, BNB was trading at $610. The increase in prices also helped it maintain fourth place after Solana [SOL] She took her place for a while.

However, expectations that Binance Coin could reach another high were not just talk. Instead, we collected many datasets that correspond to withholding.

First, we looked at events in the derivatives market. According to the data Analyzed From Coinglass, BNB derivatives volume reached $1.44 billion.

Source: Coinglas

Hold on! Obstacles ahead

This represents an increase of 15.05% over the past 24 hours, indicating strong trading activity and high risk appetite. Previously, AMBCrypto reported that several contracts were targeting a bullish end to the month.

With this trend, it may seem that bets may be in the bulls' favor. For this to happen, volume must keep rising along with price action.

But after this month, BNB's price action indicated that it may be ready to surpass its all-time high. BNB's ATH was $686.31, meaning the coin was 11.22% away from reaching value.

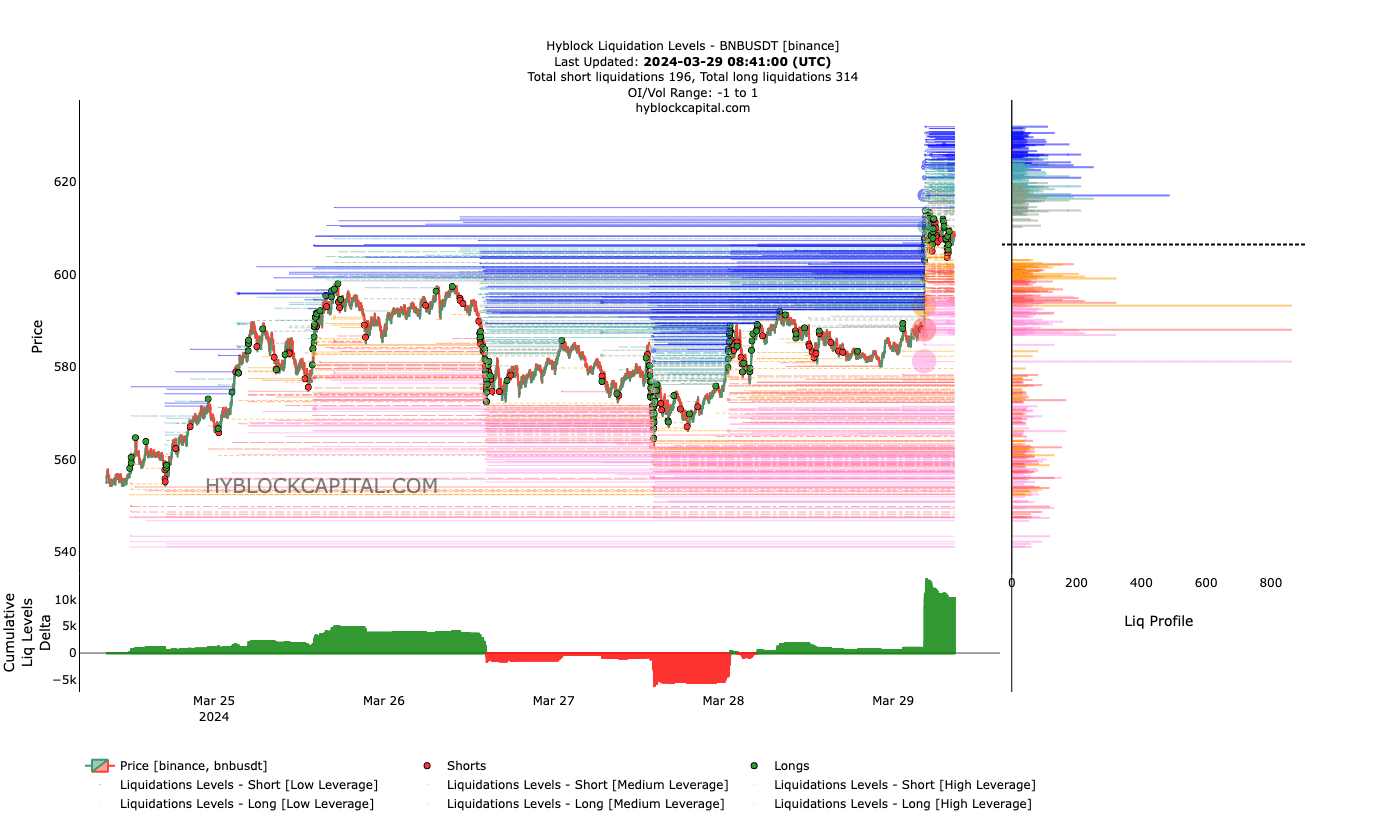

Another area we took into consideration is liquidation levels which show the potential prices at which liquidation may occur. At the time of writing, there is a range of liquidity ranging from $615 to $631.

If the currency does not face any general resistance, the price may rise towards these levels. However, it is also important to check the bias exhibited by the Cumulative Clearance Levels Delta (CLLD).

Positive values of CLLD indicate longer clearance levels. When CLLD is negative, it means short liquidation levels are higher.

Source: Hyblock

It's a direct path to the top

At the time of writing, CLLD is at a very positive point, suggesting that BNB may see a full correction. This may halt BNB's bullish momentum, and the price may fall.

However, this bearish bias may be negated if spot buying increases. If this is the case, the coin price could rise towards $640.

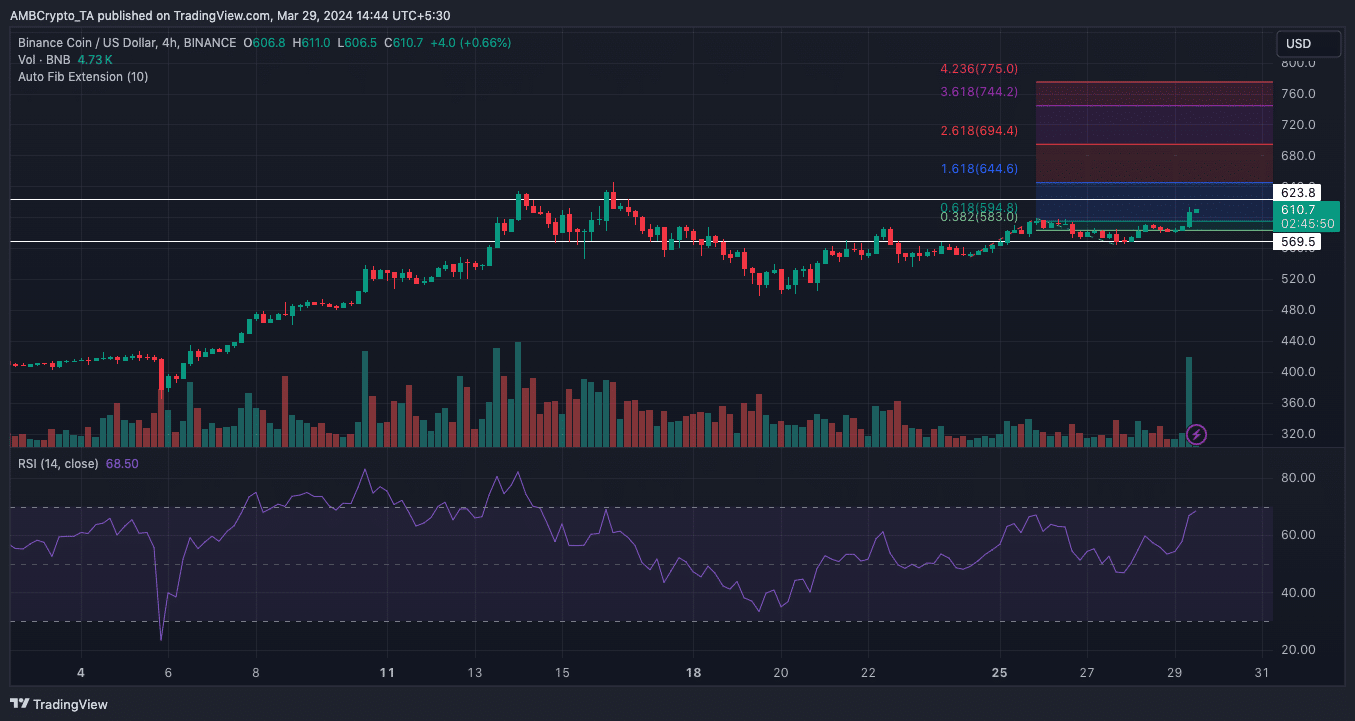

On the 4-hour time frame, BNB showed a willingness to break above the general resistance at $623. However, it depends on how well the bulls are able to defend the support at $569. As buying pressure continues, BNB may break resistance, possibly paving the way to revisit $644.

Furthermore, the Relative Strength Index (RSI) indicated that the momentum was bullish. If buyers are watching sellers, a reversal may be off the table.

Source: Trading View

Read Binance Coin [BNB] Price forecasts 2024-2025

AMBCrypto also noted the Fibonacci Extension indicator. According to signals, the price of the coin could reach $694.

In a very bullish phase, the 4.236 Fibonacci level placed the price prediction at $775.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”