- AVAX is up 5%, but is suffering from bearish signals on-chain and a split in market sentiment.

- A significant decline in derivatives trading volume indicates decreased interest in the market or potential consolidation.

Avalanche [AVAX] It has recently shown upward momentum. With its price rising more than 5% in the past day, there is growing speculation about whether AVAX is on the cusp of a massive rally.

Let’s try to figure it out.

Mixed feelings from the on-chain data

AVAX is currently priced at $27.06 with a 1% increase in the last 24 hours and a significant 5% gain previously, AVAX’s market capitalization is approximately $10.54 billion.

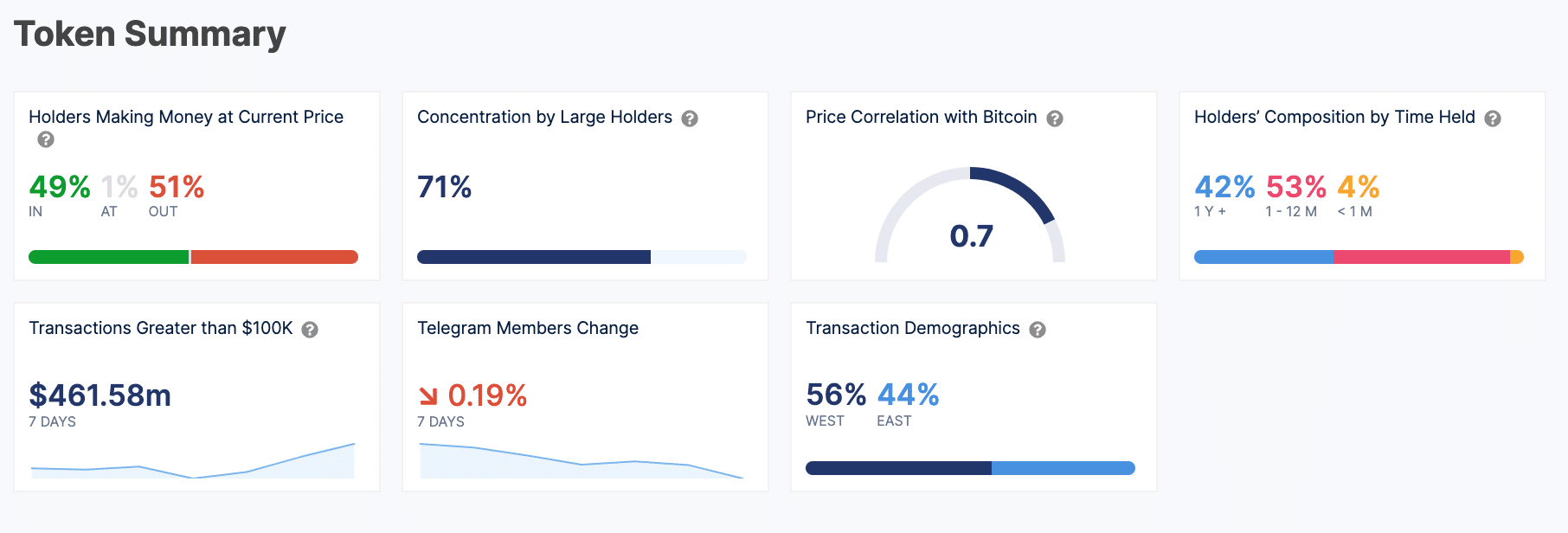

Source: IntoTheBlock

The split among bondholders earning money at the current price is relatively balanced, with dividends at 49%. AVAX saw $461 million in transactions over $110,000.

According to data provided by IntoTheBlock, sentiment and trading signals are mostly bearish.

This sentiment is supported by several bearish signals on the chain and the exchange, such as negative net growth in network transactions and a bearish bid-ask volume imbalance, which means increasing selling pressure.

However, overall sentiment remains mixed.

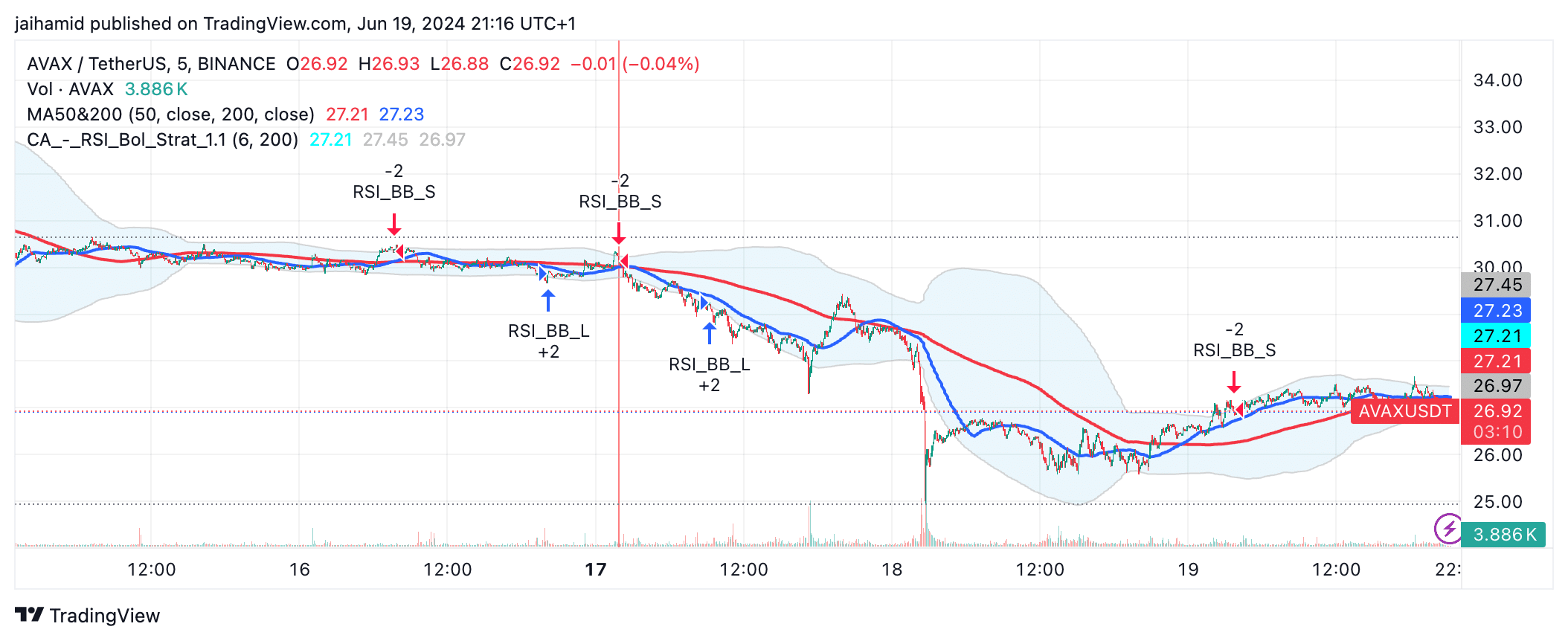

Source: Trading View

As shown in the chart above, AVAX price is moving below all averages, indicating a strong downtrend in the near term. An RSI of 40 means that the asset is neither overbought nor oversold – neither bullish nor bearish.

Bollinger Bands show that AVAX is trading mostly within bands, indicating stable volatility. Cyclical gaps below the lower band indicate that the bears are in full control, consistent with the minor declines observed.

AVAX’s derivatives trading activity declined

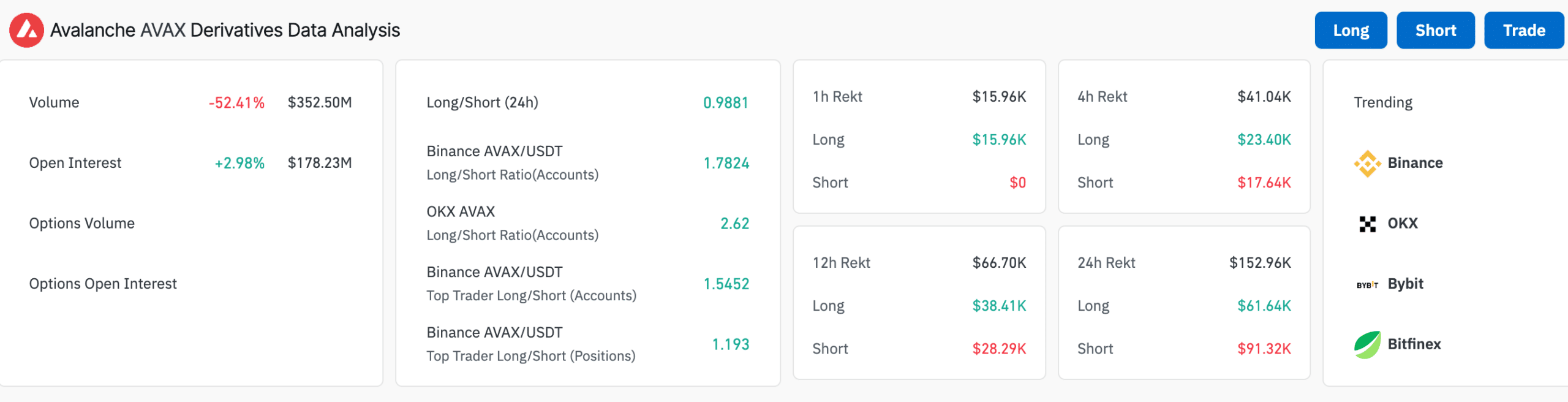

The derivatives market for AVAX couldn’t be easier.

Trading volume decreased significantly by 52.41% to $352.50 million, indicating a decline in trading activity, which could indicate a decline in interest or a consolidation phase after the recent price movements.

Source: Coinglas

Interestingly, the Binance AVAX/USDT pair shows a higher percentage of long positions (1.7824), which means that traders are more optimistic about this pair.

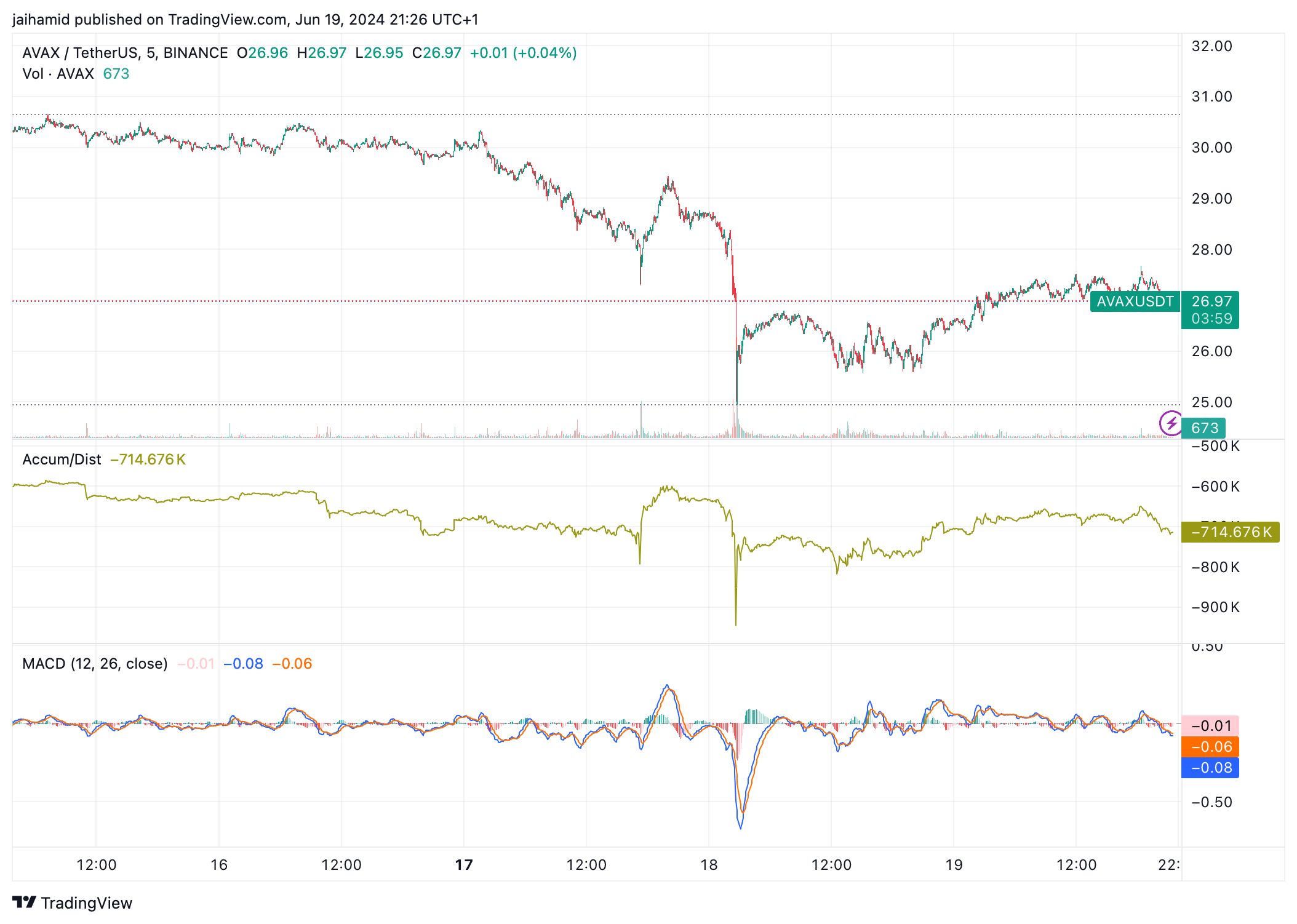

Furthermore, AVAX’s assembly/distribution line is declining.

Read Avalanche [AVAX] Price forecasts 2024-25

This trend indicates that there may be a higher distribution level than accumulation, which indicates selling pressure or a lack of new buying interest, which is a bearish signal.

Source: Trading View

The MACD, a trend-following momentum indicator, shows a bearish crossover (where the MACD line crosses below the signal line), which is usually considered a sell signal. Traders are not optimistic about AVAX.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”