Insights from Appaloosa Management’s Latest 13F Filing

David Alan Tepper, the venerable founder of Appaloosa Management, has made headlines once again with his latest 13F filing for Q2 2024. Tepper is known for his sharp investment acumen, and his strategies often reflect his deep understanding of market dynamics, honed over years of experience since his early days in Pittsburgh. Based in Miami Beach, Florida, Appaloosa Management is known for its focus on global public equity and fixed income markets, with particular expertise in distressed debt investing.

Portfolio adjustments and principal increases

During the second quarter, David Tepper (Letter, file) made significant adjustments to his portfolio, including increasing his stakes in nine stocks. Notably, Tepper’s investment in Lyft Inc.NASDAQ: LEFT) rose by 1,602.51%, adding 7,493,639 shares, for a total of 7,961,257. The move had a 1.71% impact on his current portfolio, which is valued at around $112,253,720. There was another big increase in the KraneShares CSI China Internet ETF (Quip), adding 1,015,000 shares, resulting in a 29.21% increase in the number of shares and a total value of $121,319,800.

strategic exit

Tepper’s strategy also included a complete divestment of some holdings. Notably, he sold all of Norfolk Southern Corp.’s shares (45,000 shares).NYSE:NSC), which affected the portfolio by -0.17%.

Big discounts

Tepper’s portfolio adjustments included reducing positions in 26 stocks. The most significant reduction was in NVIDIA Corp.NASDAQ:NVDA), reducing its holdings by 3,730,000 shares, representing a decrease of 84.39%. This reduction had a -4.99% impact on the portfolio. During the quarter, NVIDIA stock traded at an average price of $101.1, returning 29.19% over the past three months and 138.34% year to date. There was another significant decline in Microsoft Corp. (NASDAQ:MSFT), with the stock down 15.62%, impacting the portfolio by -1.36%.

Portfolio Overview and Sector Focus

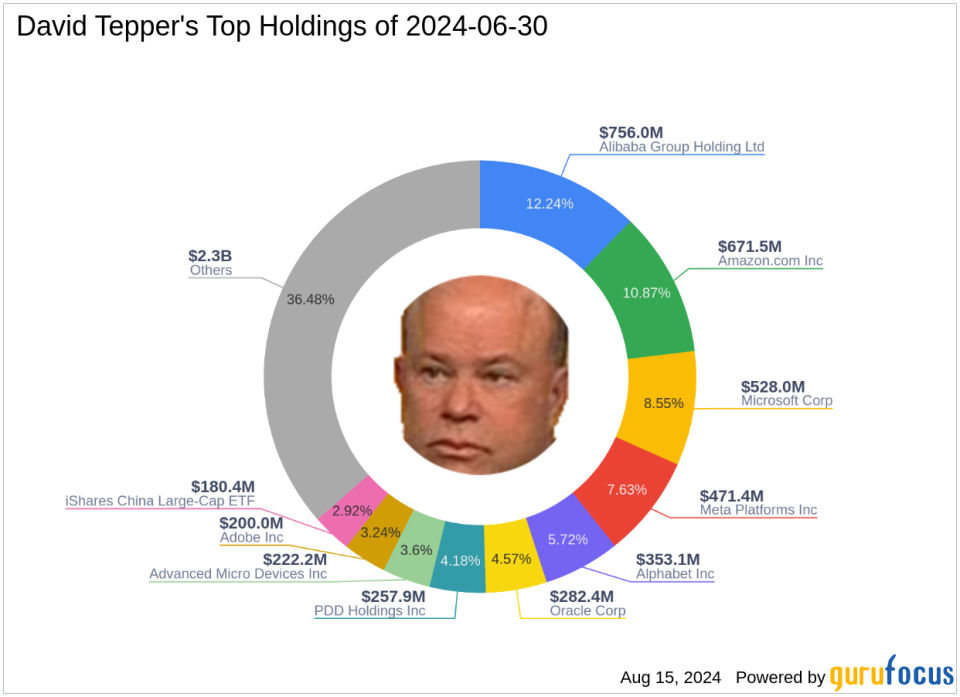

As of Q2 2024, David Tepper (Letter, fileThe company’s portfolio consists of 37 stocks. The largest holdings included a 12.24% stake in Alibaba Group Holding Ltd.New York Stock Exchange: Baba), 10.87% in Amazon.com Inc (NASDAQ:AMZN), 8.55% in Microsoft Corporation (NASDAQ:MSFT), 7.63% in Meta Platforms Inc (NASDAQ: Meta), and 5.72% in Alphabet Inc.NASDAQ:GoogleInvestments are mainly concentrated in seven sectors: technology, consumer cyclicals, communications services, energy, industries, healthcare, and real estate.

This detailed analysis of David Tepper (Letter, fileTepper’s latest 13F filing highlights his strategic investment decisions, reflecting his bullish and cautious stances across various sectors. As markets continue to evolve, Tepper’s moves provide valuable insights for investors looking to understand the complexities of portfolio management in today’s economic environment.

This article, prepared by GuruFocus, is designed to provide general insights and not personalized financial advice. Our commentary is based on historical data and analyst forecasts, using an unbiased methodology, and is not intended to provide specific investment guidance. It does not make a recommendation to buy or sell any stock and does not take into account individual investment objectives or financial circumstances. Our goal is to provide long-term analysis based on fundamental data. Please note that our analysis may not include the latest announcements of price-sensitive companies or qualitative information. GuruFocus does not take any position in the stocks mentioned here.

This article first appeared on Guru Fox.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”