- Bitcoin’s value rose by 7.4% in just 12 hours.

- Whale activity indicates a sharp increase.

Bitcoin [BTC] The stock has seen a rapid rise of 7.4% in the past 12 hours. This sudden move has everyone wondering if this is the beginning of something bigger?

Bitcoin Whales Watch At $57K

AMBCrypto’s analysis of Coinglass data shows that the big players are circling around $57,100. When whales make a move, the market tends to take notice. This price point could be where the next big push or pullback occurs.

The concentration of whale activity at this level is very important. It indicates a potential accumulation area or a level where large holders may seek to offload their wealth. Either way, this is a price point worth paying attention to.

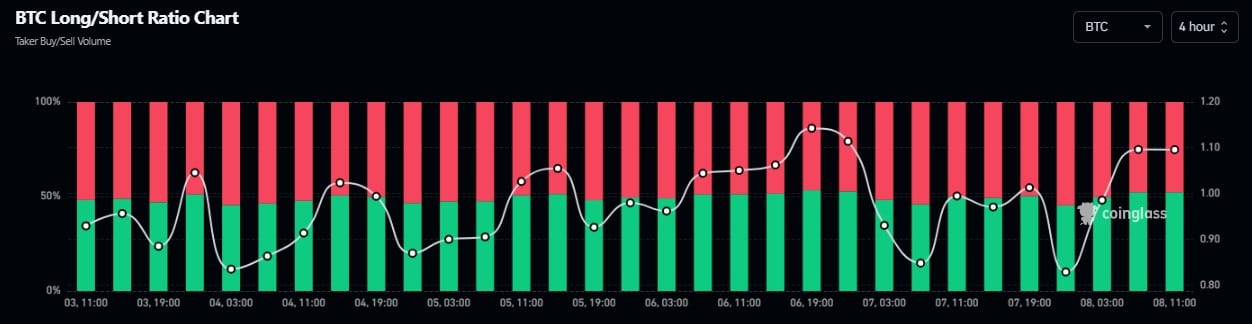

Source: Coinglass

Lots of money for little money

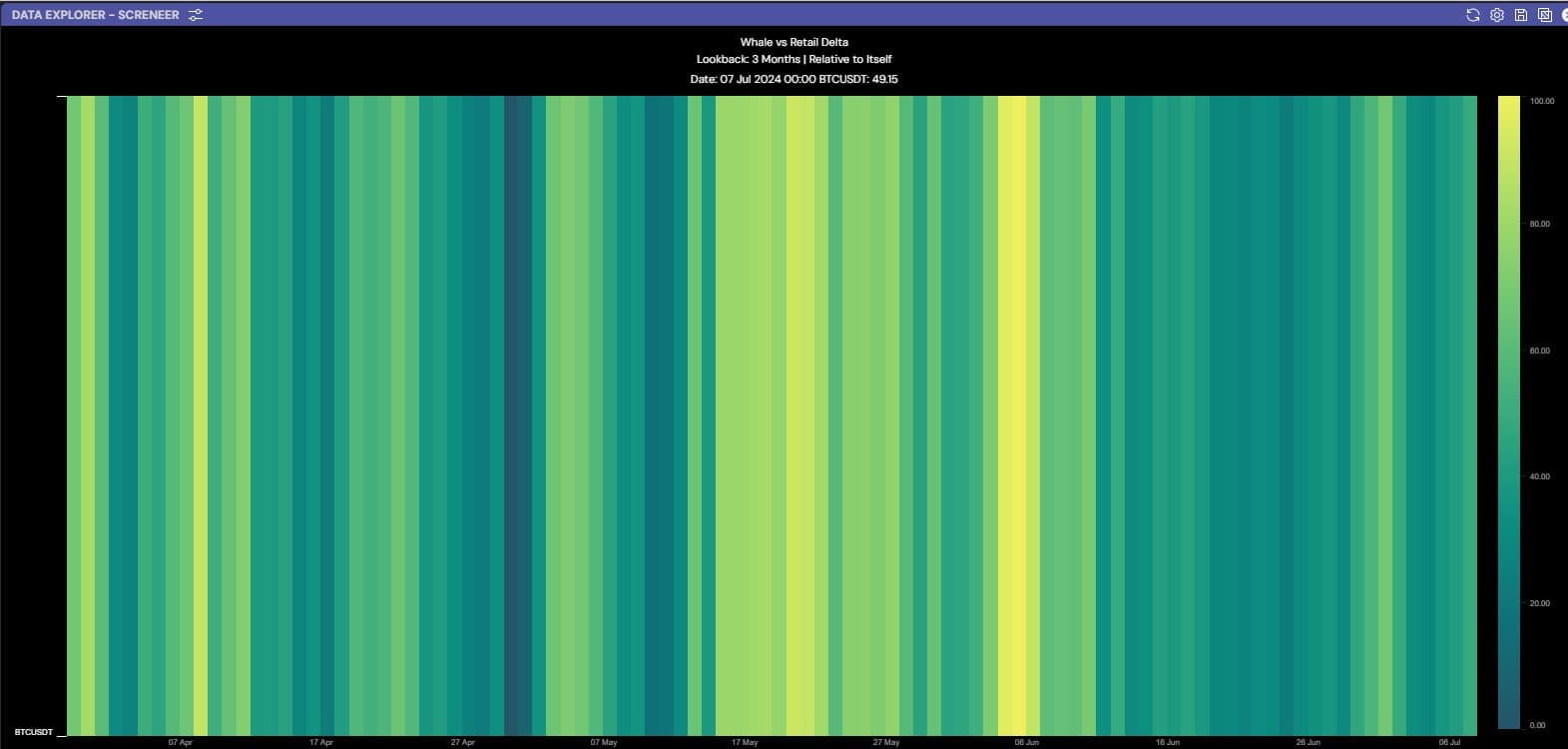

According to Hyblock data, the whale to retailer ratio is 49.15. This means that retailers are slightly outperforming whales at the moment.

This is a pretty even split, which could lead to some interesting tug-of-war between whales and individual investors.

This near-perfect equilibrium often precedes big market moves. If individual traders start piling in or whales make a coordinated move, we could see a sharp breakout in either direction.

Source: Highblock

Upward bias in long/short trades

Further analysis by AMBCrypto of Coinglass data shows that the buy-sell ratio is indeed bullish. Despite some market volatility, more investors are optimistic about further price increases.

This correlation with the recent jump in prices could fuel further upward momentum.

A rising long/long to long ratio indicates growing confidence among traders. It suggests that many are preparing for a continued bullish outlook, which could become a self-fulfilling prophecy if enough buyers step in.

Read about Bitcoin [BTC] Price forecast 2024-2025

What’s next for Bitcoin?

The rise in the price of Bitcoin attracts attention, which is positively correlated with whale buy orders. Whales are active, but many traders remain skeptical. This clash could lead to some wild price swings.

Investors should keep an eye on the $57k level. If Bitcoin can break through this level, we could see another rally.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”