- Bitwise CIO expects $15 billion to flow into Ethereum ETFs in 18 months.

- Ethereum ETFs are expected to attract significant institutional investments, boosting ETH’s position in the market.

Ethereum launch anticipated [ETH] The excitement for ETFs has reached fever pitch, with many experts beginning to speculate on possible launch dates. Industry analysts are increasingly confident that ETFs could start rolling out in mid-July.

Recent developments suggest that many applicants will file their amended S-1 forms by July 8, Bloomberg reported.

Nat Geraci, President of ETF Store, Clear Final approvals are expected by July 12, which could pave the way for the project to launch during the week of July 15.

Ethereum ETFs See $15 Billion Inflows?

Bitwise CTO, Matt Hogan, I expressed Confidence in Ethereum’s appeal to institutional investors is a sentiment that has not been widely shared until now.

In a video with analyst Scott Melker, the CTO revealed that feedback from the European and Canadian markets, where Ethereum has consistently attracted significant investment, reinforces his bullish outlook for similar success in the US market.

Hogan’s analysis goes beyond mere speculation, delving into strategic conversations with leaders of major financial institutions.

One such conversation with a $100 billion-plus consulting firm revealed a willingness to diversify into Ethereum when an official exchange-traded fund launches, highlighting the broader financial community’s growing comfort with cryptocurrencies as a legitimate asset class.

Furthermore, Hogan challenges the prevailing narrative about the close connection between cryptocurrencies and traditional financial markets.

He claims that with the exception of short periods of conformity due to extraordinary economic measures such as those we have recently witnessed, cryptocurrencies generally operate independently of traditional markets.

This independence is critical for investors seeking diversification and risk-adjusted returns.

Ethereum Battle: Market Decline and Liquidations on the Rise

Amid the broader market downturn, Ethereum’s performance mirrors that of Bitcoin, with Ethereum down about 6.2% in the past 24 hours to its current trading price of $3,139.

This huge drop has resulted in huge losses for many traders.

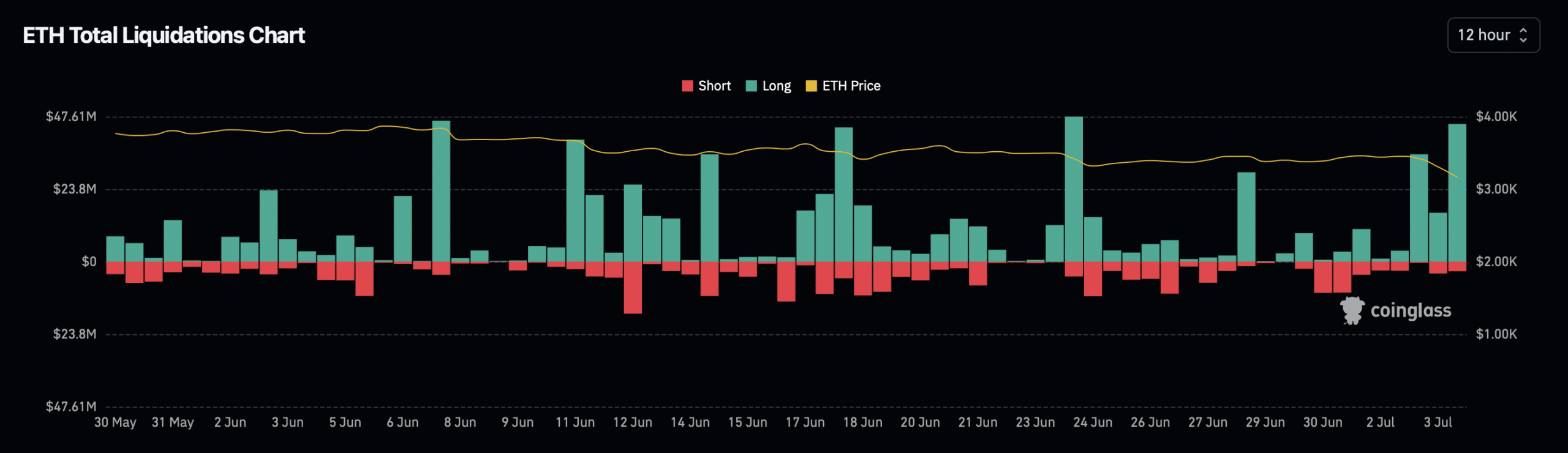

Source: Coinglass

Data Coinglass revealed that in the past 24 hours, 113,506 traders were liquidated, contributing to a total liquidation of $317.34 million.

Of this amount, Ethereum-related liquidations account for about $76.51 million, most of which is in long positions, worth $70.16 million compared to $6.35 million in short positions.

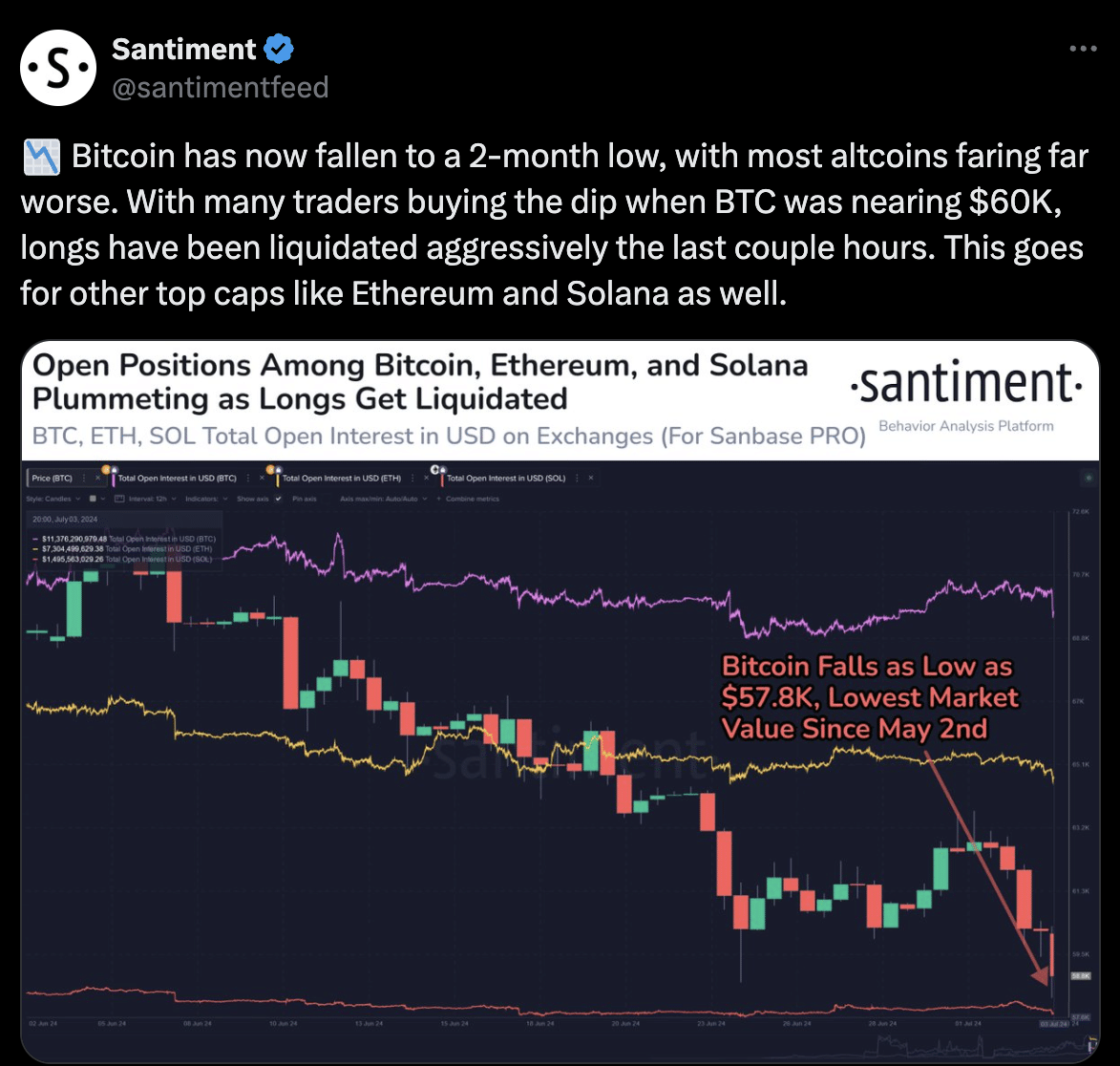

To make matters worse, market intelligence platform Santiment Reported Decrease in Ethereum open interest.

Source: Santiment

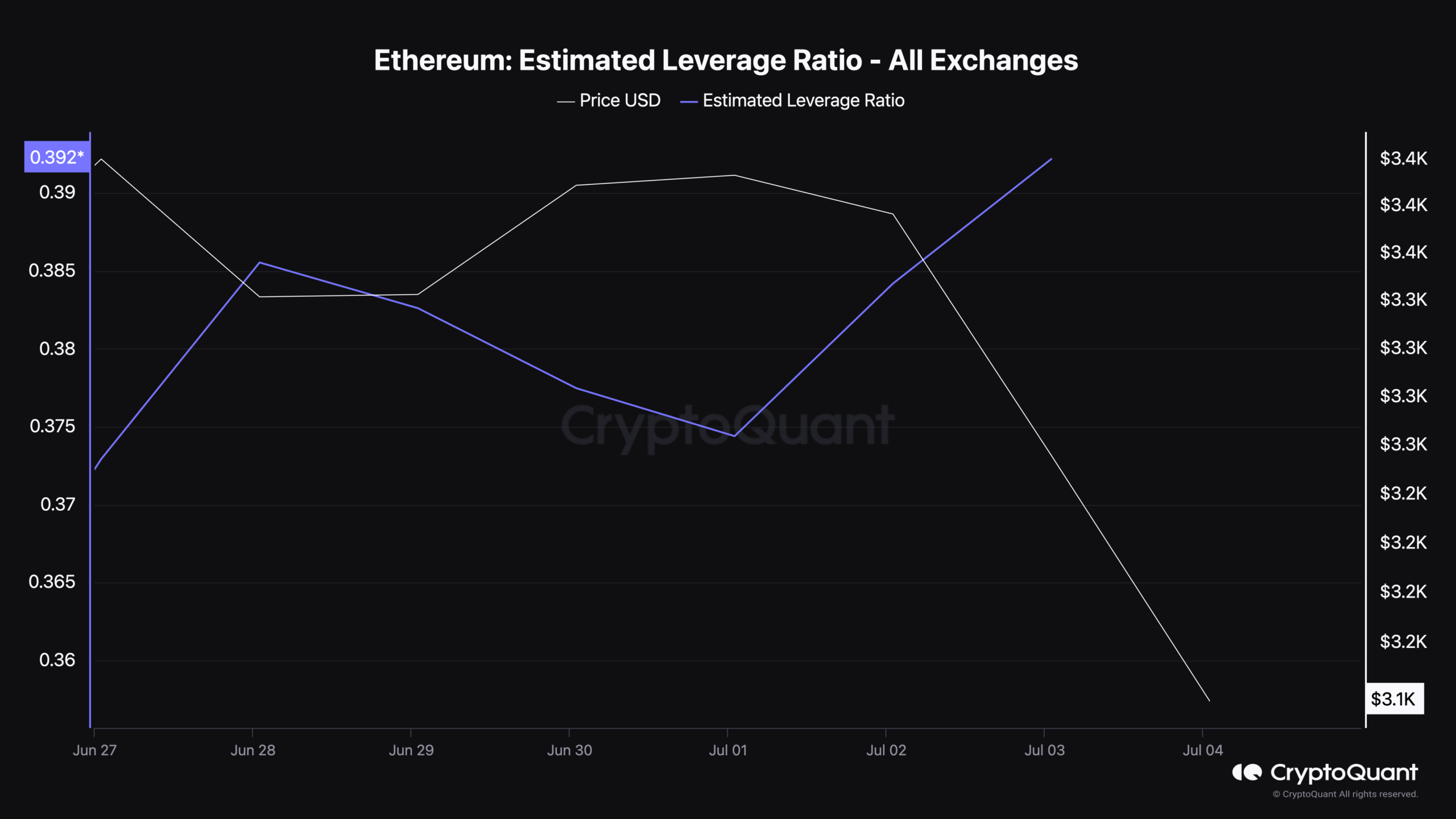

in addition to, Data CryptoQuant notes that the estimated leverage ratio for Ethereum across all exchanges has risen significantly to 0.392. This indicates an increase in leveraged positions relative to the asset’s market cap, which could indicate increased risk of volatility or further liquidation.

Source: CryptoQuant

Read about Ethereum [ETH] Price forecast 2024-2025

Despite these challenges, not all indicators for Ethereum point to a downturn.

AMBCrypto recently reported that Decentralized Applications (dApps) on Ethereum on the Riseindicating that some areas of the Ethereum ecosystem are still seeing strong activity.

“Devoted student. Bacon advocate. Beer scholar. Troublemaker. Falls down a lot. Typical coffee enthusiast.”